Question: For full or partial credit, you must show all work. After reading carefully, if you do not fully understand the problem statement, you can make

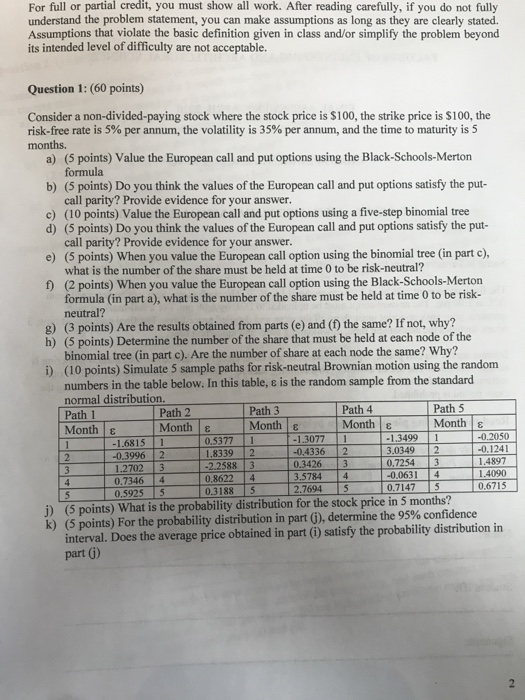

For full or partial credit, you must show all work. After reading carefully, if you do not fully understand the problem statement, you can make assumptions as long as they are clearly stated. Assumptions that violate the basic definition given in class and/or simplify the problem beyond its intended level of difficulty are not acceptable. Question 1: (60 points) Consider a non-divided-paying stock where the stock price is $100, the strike price is $100, the risk-free rate is 5% per annum, the volatility is 35% per annum, and the time to maturity is 5 months. a) (5 points) Value the European call and put options using the Black-Schools-Merton formula b) (5 points) Do you think the values of the European call and put options satisfy the put- call parity? Provide evidence for your answer. c) (10 points) Value the European call and put options using a five-step binomial tree d) (5 points) Do you think the values of the European call and put options satisfy the put- call parity? Provide evidence for your answer. e) (5 points) When you value the European call option using the binomial tree (in parte), what is the number of the share must be held at time 0 to be risk-neutral? f) (2 points) When you value the European call option using the Black-Schools-Merton formula (in part a), what is the number of the share must be held at time to be risk neutral? 8) (3 points) Are the results obtained from parts (e) and (f) the same? If not, why? h) (5 points) Determine the number of the share that must be held at each node of the binomial tree (in part c). Are the number of share at each node the same? Why? i) (10 points) Simulate 5 sample paths for risk-neutral Brownian motion using the random numbers in the table below. In this table, e is the random sample from the standard normal distribution. Path 1 Path 2 Path 3 Path 4 Path 5 Month Month Month Month & Months -1.68151 0 .5377 1 -1.30771 -1.34991 -0.2050 2 -0.3996 2 1 .8339 2 0 .4336 2 3.03492 -0.1241 3 1 .27023 -2.25883 0.34263 0.7254 3 1 .4897 0.7346 4 0 ,86224 3.5784 4 -0.0631 4 1.4090 5 0 .5925 S 0.31885 2.76945 0.71475 0.6715 j) (5 points) What is the probability distribution for the stock price in 5 months? k) (5 points) For the probability distribution in part (), determine the 95% confidence interval. Does the average price obtained in part (i) satisfy the probability distribution in part()

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts