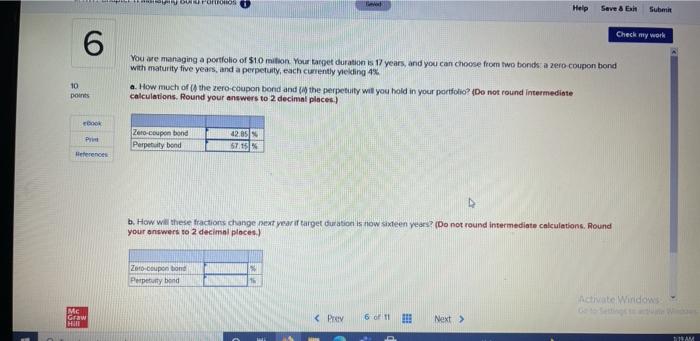

Question: For Help Seve & Exh Subm Check my work 6 You are managing a portfolio of $10 milion Your target duration is 17 years, and

For Help Seve & Exh Subm Check my work 6 You are managing a portfolio of $10 milion Your target duration is 17 years, and you can choose from two bonds a zero coupon bond with maturity five years, and a perpetuity, each currently yielding 4% a. How much of the zero coupon bond and the perpetuity will you hold in your portfolio? (Do not round Intermediate calculations. Round your answers to 2 decimal places) 10 points OR Pri Zero-coupon bond Perpetuty bond 12.85 57.15% Heferences b. How will these tractions change next year if target duration is now sixteen years? (Do not round intermediate calculations. Round your answers to 2 decimal places Zoro couponbond Perpetuty bond Activate Window MC Hill Graw AN For Help Seve & Exh Subm Check my work 6 You are managing a portfolio of $10 milion Your target duration is 17 years, and you can choose from two bonds a zero coupon bond with maturity five years, and a perpetuity, each currently yielding 4% a. How much of the zero coupon bond and the perpetuity will you hold in your portfolio? (Do not round Intermediate calculations. Round your answers to 2 decimal places) 10 points OR Pri Zero-coupon bond Perpetuty bond 12.85 57.15% Heferences b. How will these tractions change next year if target duration is now sixteen years? (Do not round intermediate calculations. Round your answers to 2 decimal places Zoro couponbond Perpetuty bond Activate Window MC Hill Graw AN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts