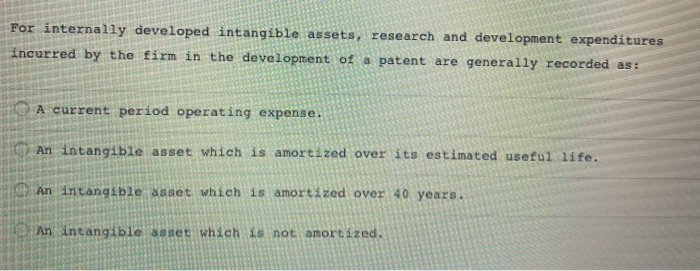

Question: For internally developed intangible assets, research and development expenditures incurred by the firm in the development of a patent are generally recorded as: A current

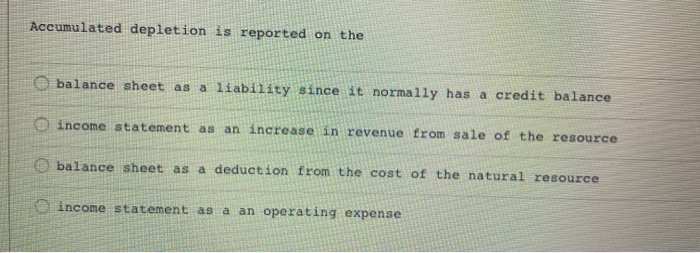

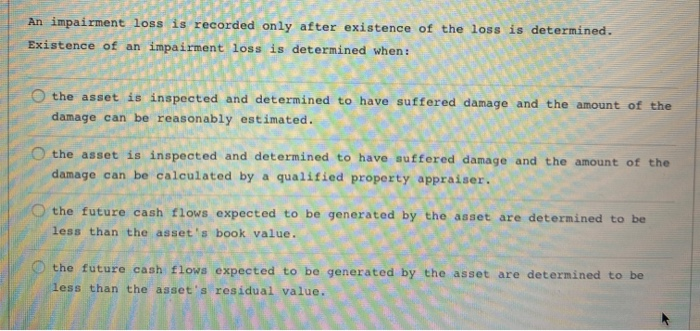

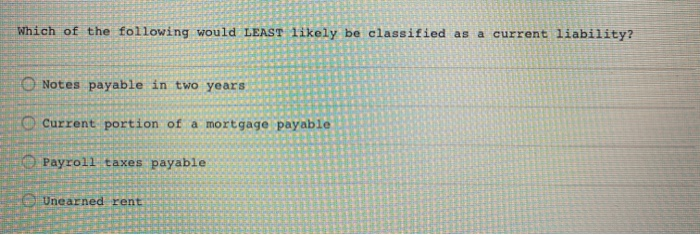

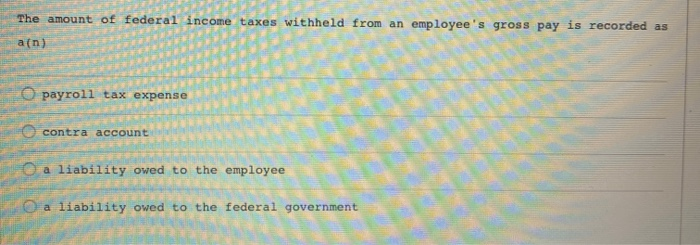

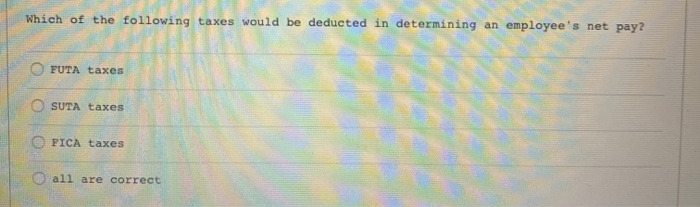

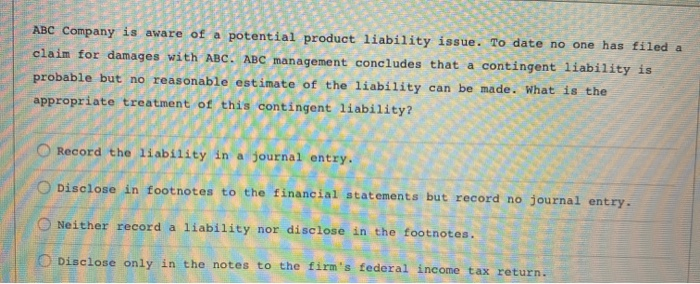

For internally developed intangible assets, research and development expenditures incurred by the firm in the development of a patent are generally recorded as: A current period operating expense. An intangible asset which is amortized over its estimated useful life. An intangible asset which is amortized over 40 years. An intangible asset which is not amortized. Accumulated depletion is reported on the balance sheet as a liability since it normally has a credit balance income statement as an increase in revenue from sale of the resource balance sheet as a deduction from the cost of the natural resource income statement as a an operating expense An impairment loss is recorded only after existence of the loss is determined. Existence of an impairment loss is determined when : the asset is inspected and determined to have suffered damage and the amount of the damage can be reasonably estimated. the asset is inspected and determined to have suffered damage and the amount of the damage can be calculated by a qualified property appraiser. the future cash flows expected to be generated by the asset are determined to be less than the asset's book value. the future cash flows expected to be generated by the asset are determined to be less than the asset's residual value. Which of the following would LEAST likely be classified as a current liability? O Notes payable in two years 0 0 0 Current portion of a mortgage payable Payroll taxes payable Unearned rent The amount of federal income taxes withheld from an employee's gross pay is recorded as a(n) O payroll tax expense contra account a liability owed to the employee a liability owed to the federal government Which of the following taxes would be deducted in determining an employee's net pay? FUTA taxes SUTA taxes FICA taxes all are correct ABC Company is aware of a potential product liability issue. To date no one has filed a claim for damages with ABC. ABC management concludes that a contingent liability is probable but no reasonable estimate of the liability can be made. What is the appropriate treatment of this contingent liability? Record the liability in a journal entry. Disclose in footnotes to the financial statements but record no journal entry. Neither record a liability nor disclose in the footnotes. Disclose only in the notes to the firm's federal income tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts