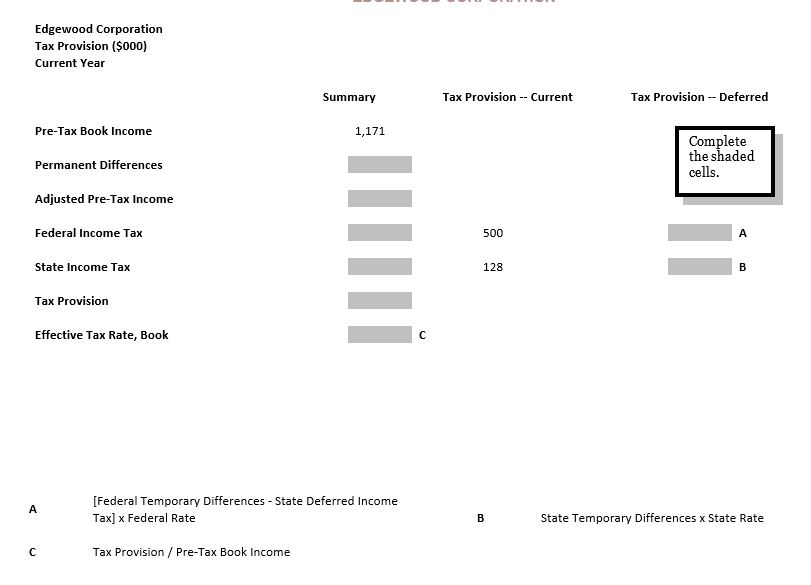

Question: For items I and II, use the format found in the partially completed Trial Balance (Summary) for EdgeHood. I) Using the information provided, compute book

For items I and II, use the format found in the partially completed Trial Balance (Summary) for EdgeHood.

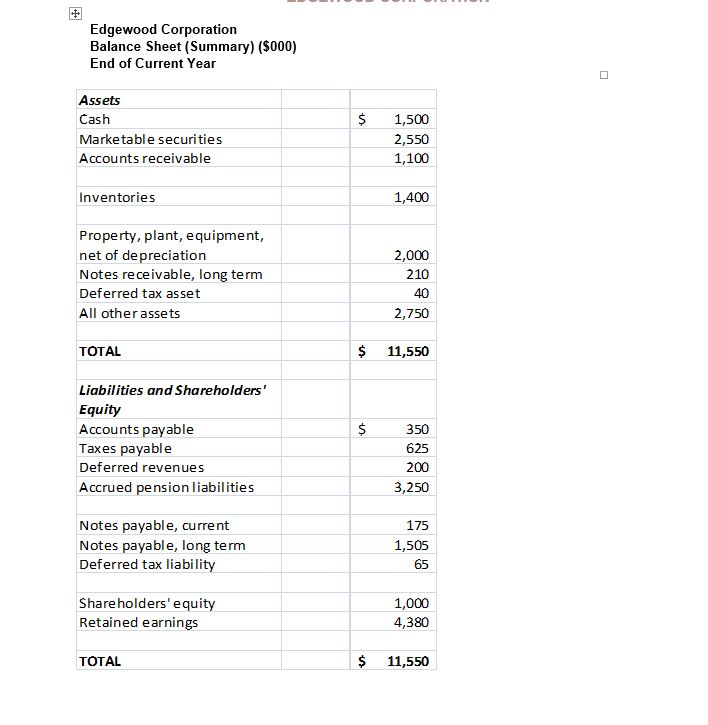

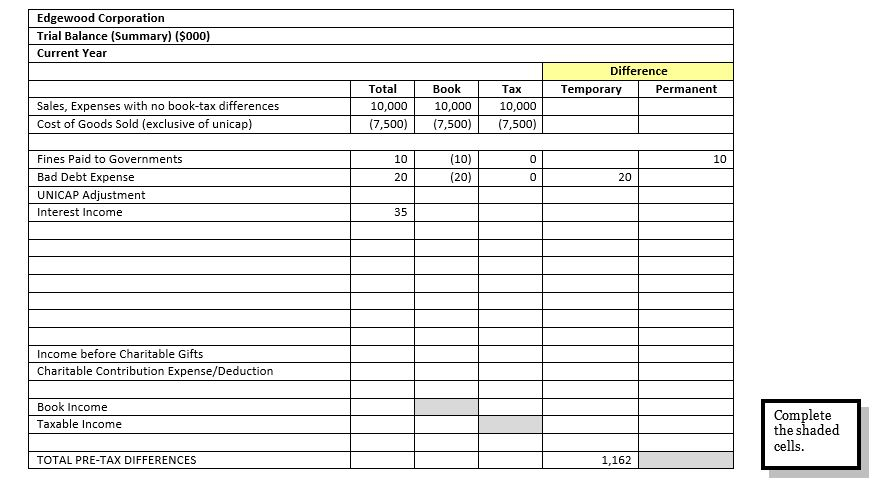

I) Using the information provided, compute book income before taxes for Edgewood.

II)Identify and measure Edgewoods book-tax differences. Classify each of the book-tax differences as temporary or permanent.

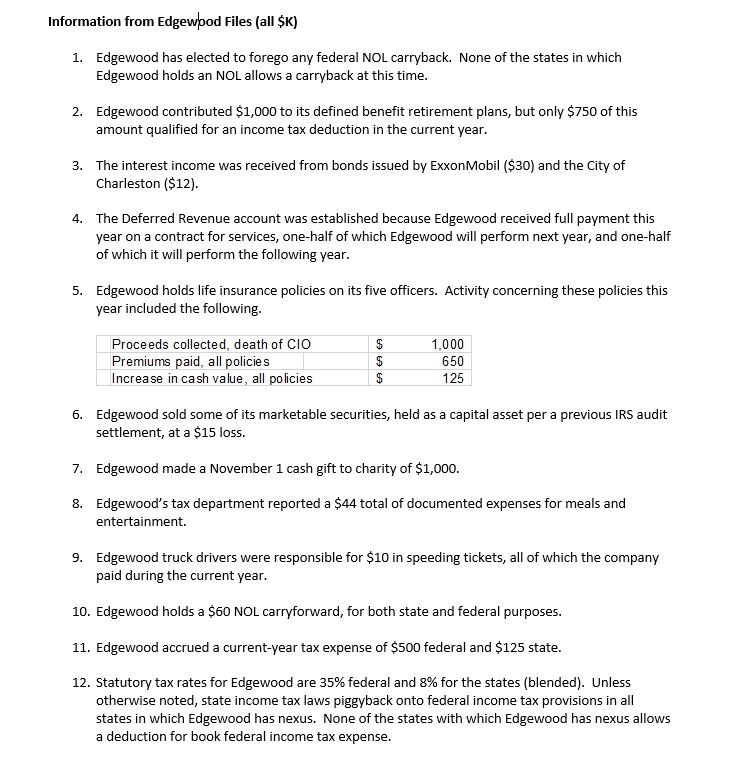

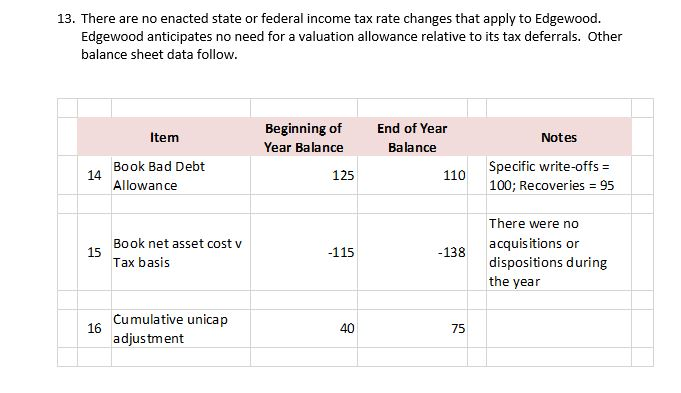

Information from Edgewpod Files (all $K) Edgewood has elected to forego any federal NOL carryback. None of the states in which Edgewood holds an NOL allows a carryback at this time 1. Edgewood contributed $1,000 to its defined benefit retirement plans, but only $750 of this amount qualified for an income tax deduction in the current year 2. The interest income was received from bonds issued by ExxonMobil ($30) and the City of Charleston ($12) 3. The Deferred Revenue account was established because Edgewood received full payment this year on a contract for services, one-half of which Edgewood will perform next year, and one-half of which it will perform the following year 4. 5. Edgewood holds life insurance policies on its five officers. Activity concerning these policies this year included the following Proceeds collected, death of CIO 1,000 650 125 Premiums paid, all policies ncrease in cash value, all policies 6. Edgewood sold some of its marketable securities, held as a capital asset per a previous IRS audit settlement, at a $15 loss. Edgewood made a November 1 cash gift to charity of $1,000 Edgewood's tax department reported a $44 total of documented expenses for meals and 7. 8. entertainment. Edgewood truck drivers were responsible for $10 in speeding tickets, all of which the company paid during the current year 9. 10. Edgewood holds a $60 NOL carryforward, for both state and federal purposes. 11. Edgewood accrued a current-year tax expense of $500 federal and $125 state 12, statutory tax rates for Edgewood are 35% federal and 8% for the states (blended). Unless otherwise noted, state income tax laws piggyback onto federal income tax provisions in all states in which Edgewood has nexus. None of the states with which Edgewood has nexus allows a deduction for book federal income tax expense Information from Edgewpod Files (all $K) Edgewood has elected to forego any federal NOL carryback. None of the states in which Edgewood holds an NOL allows a carryback at this time 1. Edgewood contributed $1,000 to its defined benefit retirement plans, but only $750 of this amount qualified for an income tax deduction in the current year 2. The interest income was received from bonds issued by ExxonMobil ($30) and the City of Charleston ($12) 3. The Deferred Revenue account was established because Edgewood received full payment this year on a contract for services, one-half of which Edgewood will perform next year, and one-half of which it will perform the following year 4. 5. Edgewood holds life insurance policies on its five officers. Activity concerning these policies this year included the following Proceeds collected, death of CIO 1,000 650 125 Premiums paid, all policies ncrease in cash value, all policies 6. Edgewood sold some of its marketable securities, held as a capital asset per a previous IRS audit settlement, at a $15 loss. Edgewood made a November 1 cash gift to charity of $1,000 Edgewood's tax department reported a $44 total of documented expenses for meals and 7. 8. entertainment. Edgewood truck drivers were responsible for $10 in speeding tickets, all of which the company paid during the current year 9. 10. Edgewood holds a $60 NOL carryforward, for both state and federal purposes. 11. Edgewood accrued a current-year tax expense of $500 federal and $125 state 12, statutory tax rates for Edgewood are 35% federal and 8% for the states (blended). Unless otherwise noted, state income tax laws piggyback onto federal income tax provisions in all states in which Edgewood has nexus. None of the states with which Edgewood has nexus allows a deduction for book federal income tax expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts