Question: For Johnson and Johnson, I need help determining the PV and NPV based off the end of Q1 of 2022 and Q1 of 2021 for

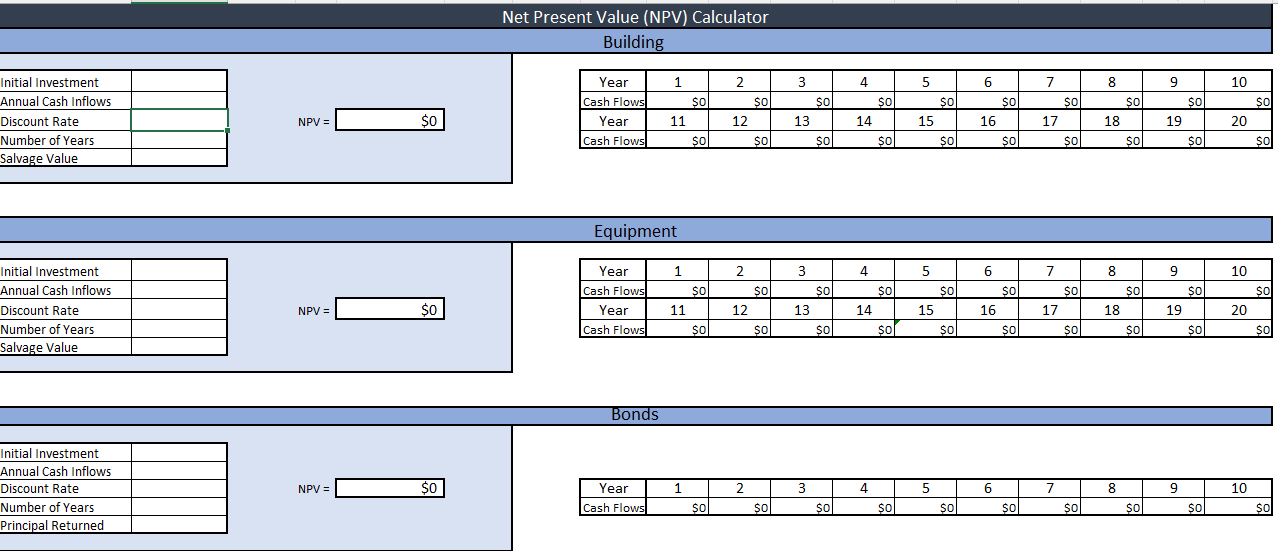

For Johnson and Johnson, I need help determining the PV and NPV based off the end of Q1 of 2022 and Q1 of 2021 for the same company. Below are the tables. Thanks!

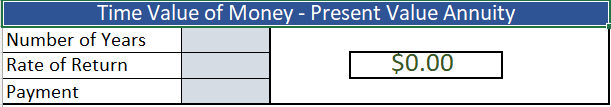

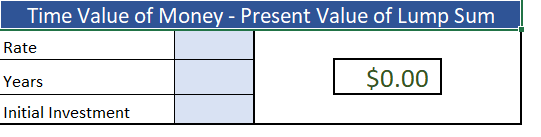

Time Value of Money - Present Value Annuity $0.00 Number of Years Rate of Return Payment Initial Investment Annual Cash Inflows Discount Rate Number of Years Salvage Value Initial Investment Annual Cash Inflows Discount Rate Number of Years Salvage Value Initial Investment Annual Cash Inflows Discount Rate Number of Years Principal Returned NPV = NPV = NPV = $0 $0 $0 Net Present Value (NPV) Calculator Building 2 12 Year Cash Flows Year Cash Flows Equipment Year 1 Cash Flows 11 Year Cash Flows Bonds 1 11 Year Cash Flows 1 $0 $O SO $0 $0 2 12 $0 $O $O SO 2 $0 3 13 3 13 $0 SO $O $O 3 $o 4 14 4 14 $0 $O $0 $0 4 SO 5 15 5 15 5 $0 SO $0 $O $0 6 16 6 16 $0 $0 $0 $O 6 $o 7 17 7 17 $0 $0 $0 $0 7 SO 8 18 8 18 $0 $0 $O $0 8 SO 9 19 9 19 $0 $O $0 $0 9 so 10 $0 20 $0 10 20 $O $0 10 $0 Time Value of Money - Present Value of Lump Sum Rate $0.00 Years Initial Investment Time Value of Money - Present Value Annuity $0.00 Number of Years Rate of Return Payment Initial Investment Annual Cash Inflows Discount Rate Number of Years Salvage Value Initial Investment Annual Cash Inflows Discount Rate Number of Years Salvage Value Initial Investment Annual Cash Inflows Discount Rate Number of Years Principal Returned NPV = NPV = NPV = $0 $0 $0 Net Present Value (NPV) Calculator Building 2 12 Year Cash Flows Year Cash Flows Equipment Year 1 Cash Flows 11 Year Cash Flows Bonds 1 11 Year Cash Flows 1 $0 $O SO $0 $0 2 12 $0 $O $O SO 2 $0 3 13 3 13 $0 SO $O $O 3 $o 4 14 4 14 $0 $O $0 $0 4 SO 5 15 5 15 5 $0 SO $0 $O $0 6 16 6 16 $0 $0 $0 $O 6 $o 7 17 7 17 $0 $0 $0 $0 7 SO 8 18 8 18 $0 $0 $O $0 8 SO 9 19 9 19 $0 $O $0 $0 9 so 10 $0 20 $0 10 20 $O $0 10 $0 Time Value of Money - Present Value of Lump Sum Rate $0.00 Years Initial Investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts