Question: for journal entries it should be 5 part each has 2 Crane Construction Company uses the percentage-of-completion method of accounting. In 2020, Crane began work

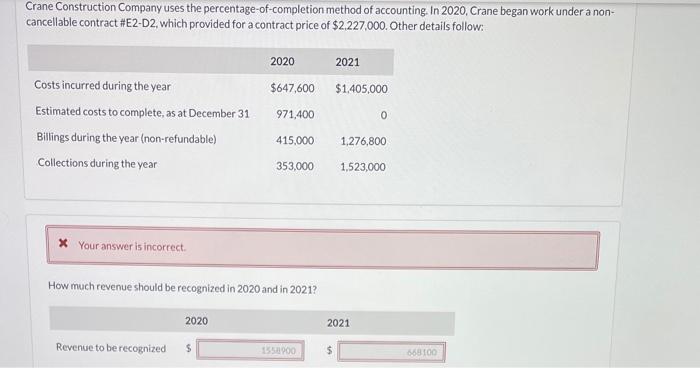

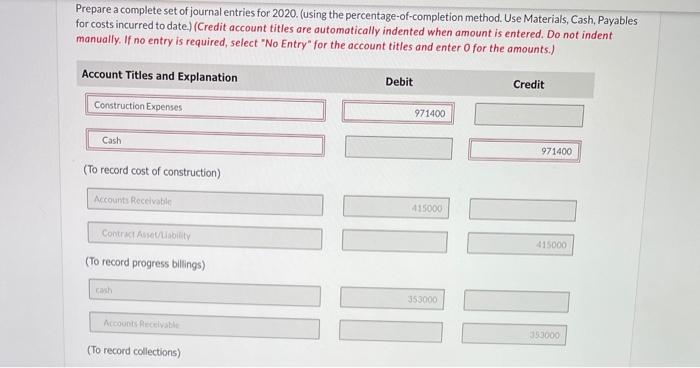

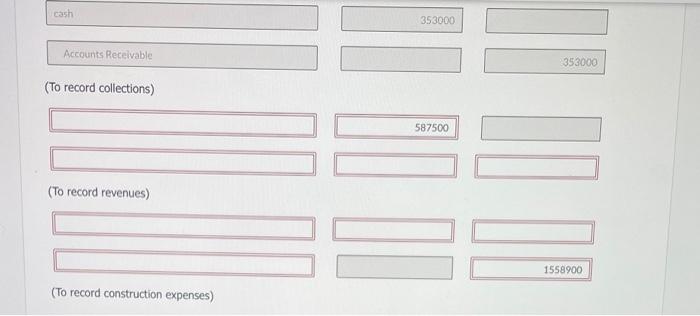

Crane Construction Company uses the percentage-of-completion method of accounting. In 2020, Crane began work under a non- cancellable contract #E2-D2, which provided for a contract price of $2,227.000. Other details follow: 2020 2021 $647,600 $1.405,000 971,400 0 Costs incurred during the year Estimated costs to complete, as at December 31 Billings during the year (non-refundable) Collections during the year 415,000 1,276,800 353,000 1,523,000 X Your answer is incorrect. How much revenue should be recognized in 2020 and in 2021? 2020 2021 Revenue to be recognized $ 1350000 568100 Prepare a complete set of journal entries for 2020. (using the percentage-of-completion method. Use Materials, Cash, Payables for costs incurred to date.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Construction Expenses 971400 Cash 971400 (To record cost of construction) Nccounts Receivable 415000 Contract Asset/usbility 415000 (To record progress billings) cach 353000 Accounts Receivable 353000 (To record collections) cash 353000 Accounts Receivable 353000 (To record collections) 587500 (To record revenues) 1558900 (To record construction expenses)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts