Question: for journal entry options: no journal entry required accounts payable accounts receivable costs of goods sold direct materials production overhead sales revenue various accounts wages

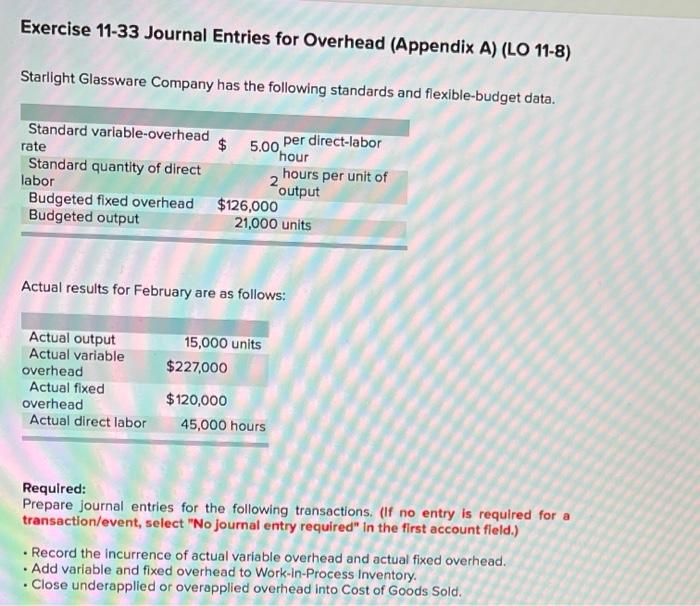

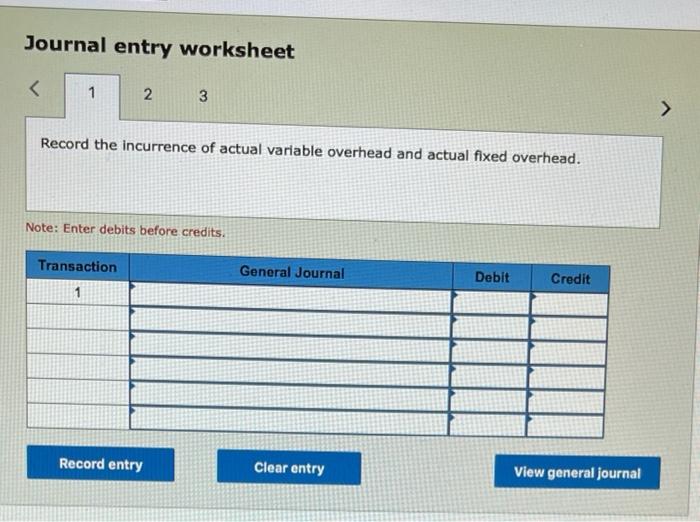

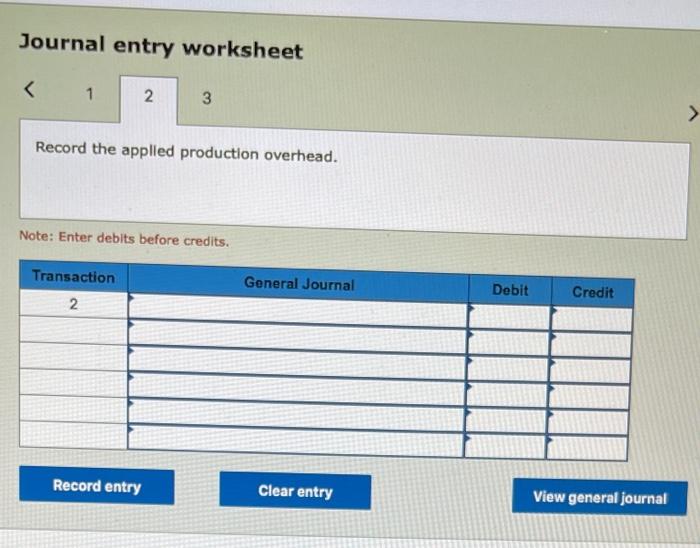

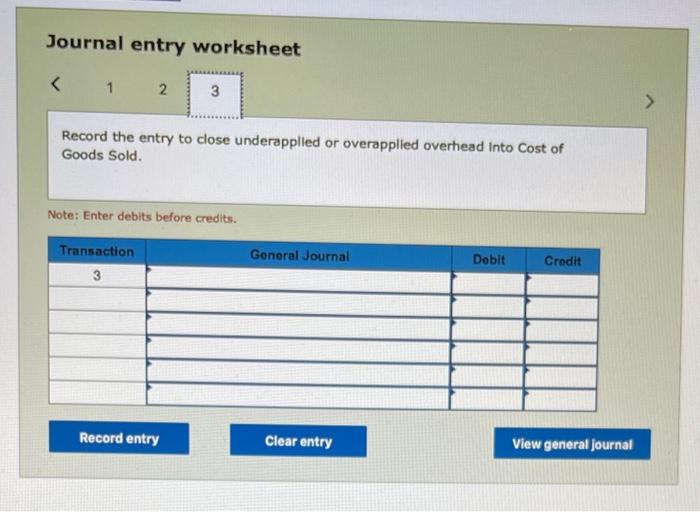

Exercise 11-33 Journal Entries for Overhead (Appendix A) (LO 11-8) Starlight Glassware Company has the following standards and flexible-budget data. Standard variable-overhead rate Standard quantity of direct labor Budgeted fixed overhead Budgeted output $ 5.00 per direct-labor hour hours per unit of 2 output $126,000 21,000 units Actual results for February are as follows: 15,000 units $227,000 Actual output Actual variable overhead Actual fixed overhead Actual direct labor $120,000 45,000 hours Required: Prepare journal entries for the following transactions. (If no entry is required for a transaction/event, select "No journal entry required" In the first account field.) Record the incurrence of actual variable overhead and actual fixed overhead. Add variable and fixed overhead to Work-in-Process Inventory. Close underapplied or overapplied overhead into Cost of Goods Sold. - . Journal entry worksheet 1 2 3 Record the incurrence of actual variable overhead and actual fixed overhead. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal Journal entry worksheet Record the applied production overhead. Note: Enter debits before credits. Transaction General Journal Debit Credit 2 Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts