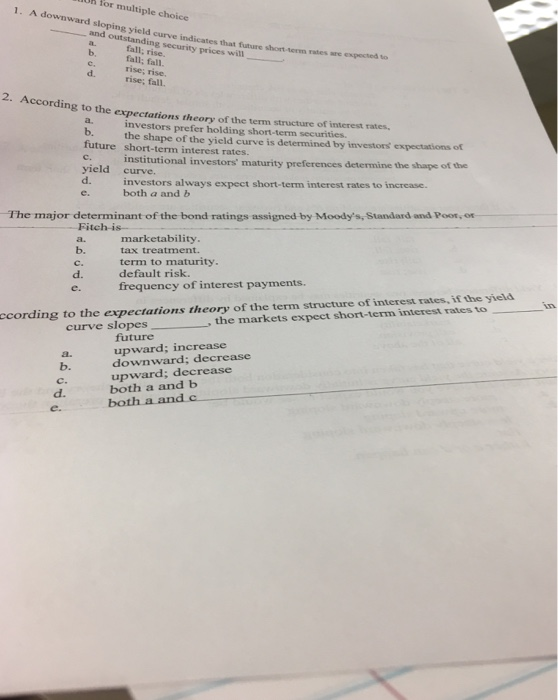

Question: for multiple choice 1. A downward sloping yield curve indicates that future short term rates are expected to and b, d. outstanding that security prices

for multiple choice 1. A downward sloping yield curve indicates that future short term rates are expected to and b, d. outstanding that security prices will fall; rise. fall; fall. rise; rise. rise; fall. 2. According to the e expectations theory of the term structure of interest rates b. future short-term interest rates. investors prefer holding short-term securities. the shape of the yield curve is determined by investors expectations of c. institutional investors' maturity preferences determine the shape of the yield curve. d. e. investors always expect short-term interest rates to increase. both a and b The major determinant of the bond ratings assigned by Moody's, Standard and Poot, or Fitch-is_ b. c. d. marketability tax treatment. term to maturity. default risk. e. frequency of interest payments. ccording to the expectations theory of the term structure of interest rates, if the yield _ _ __-, the markets expect short-terminerest rates to curve slopes _ future upward; increase downward; decrease upward; decrease both a and b both a and c b. C. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts