Question: For part a) I believe I'm solving Vk(t,T) = St - K*e^-(r*t) where St is current price of asset, K = delivery price, e is

For part a)

For part a)

I believe I'm solving Vk(t,T) = St - K*e^-(r*t) where St is current price of asset, K = delivery price, e is Euler's constant. 30-(25/(e^(.03*2))) = 6.46 ; Would I even use this formula since I am compounding annually, not continuously?

OR I might be solving for F(t,T) = St/ z (t,T) = 35/e^-(.03*2) = 37.16

For part b)

ST = 35; so the value of the long counterparty would be ST - whatever long party originally paid for the forward.

This would be 35 - answer from part a

Thanks

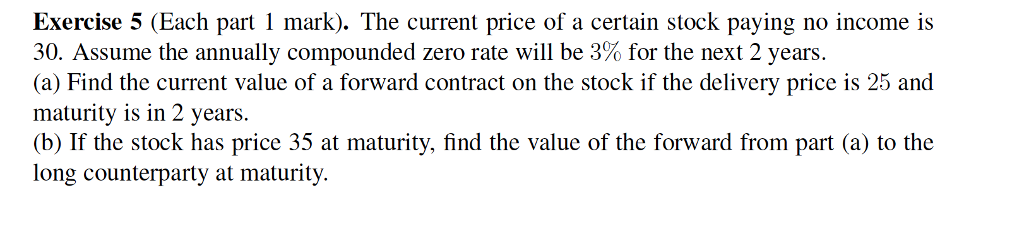

Exercise 5 (Each part 1 mark). The current price of a certain stock paying no income is 30. Assume the annually compounded zero rate will be 3% for the next 2 years. (a) Find the current value of a forward contract on the stock if the delivery price is 25 and maturity is in 2 years (b) If the stock has price 35 at maturity, find the value of the forward from part (a) to the long counterparty at maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts