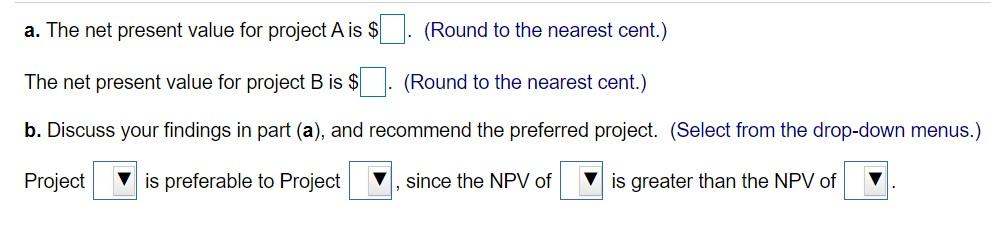

Question: For part b. the drop-down choices are B or A, B or A, B or A, B or A. Risk-adjusted discount ratesTabular After a careful

For part b. the drop-down choices are B or A, B or A, B or A, B or A.

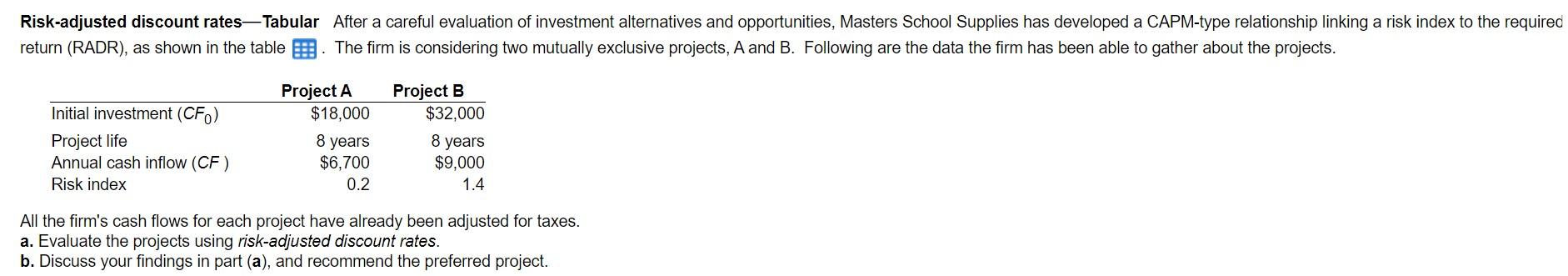

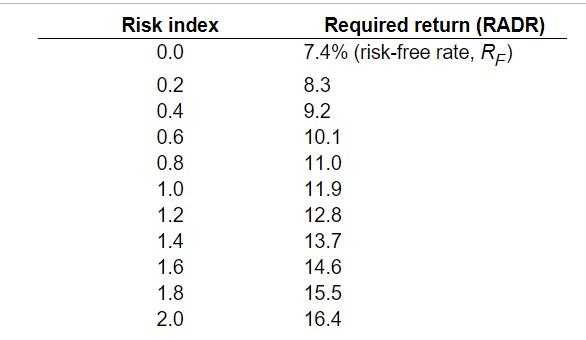

Risk-adjusted discount ratesTabular After a careful evaluation of investment alternatives and opportunities, Masters School Supplies has developed a CAPM-type relationship linking a risk index to the required return (RADR), as shown in the table 1. The firm is considering two mutually exclusive projects, A and B. Following are the data the firm has been able to gather about the projects. Project A $18,000 Project B $32,000 Initial investment (CF) Project life Annual cash inflow (CF) Risk index 8 years 8 years $6,700 0.2 $9,000 1.4 All the firm's cash flows for each project have already been adjusted for taxes. a. Evaluate the projects using risk-adjusted discount rates. b. Discuss your findings in part (a), and recommend the preferred project. Risk index 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 Required return (RADR) 7.4% (risk-free rate, Rp) 8.3 9.2 10.1 11.0 11.9 12.8 13.7 14.6 15.5 16.4 a. The net present value for project A is $ (Round to the nearest cent.) The net present value for project B is $ (Round to the nearest cent.) b. Discuss your findings in part (a), and recommend the preferred project. (Select from the drop-down menus.) Project is preferable to Project since the NPV of V is greater than the NPV of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts