Question: For part C, why do we have accumulated depreciation = $18000, GST payable = $4000 and gain on sale of delivery van = $8000? 3.

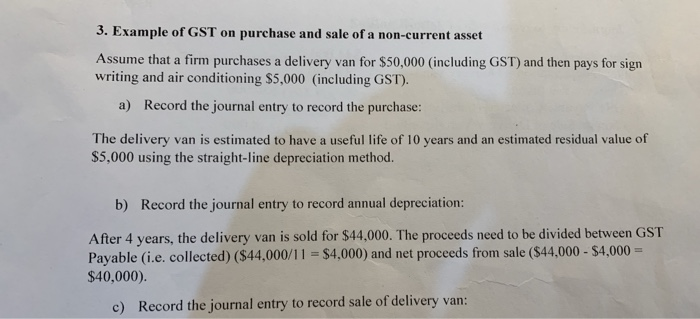

3. Example of GST on purchase and sale of a non-current asset Assume that a firm purchases a delivery van for $50,000 (including GST) and then pays for sign writing and air conditioning $5,000 (including GST). a) Record the journal entry to record the purchase: The delivery van is estimated to have a useful life of 10 years and an estimated residual value of $5,000 using the straight-line depreciation method. b) Record the journal entry to record annual depreciation: After 4 years, the delivery van is sold for $44,000. The proceeds need to be divided between GST Payable (i.e. collected) ($44,000/11 = $4,000) and net proceeds from sale ($44,000 - $4,000 = $40,000). c) Record the journal entry to record sale of delivery van

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts