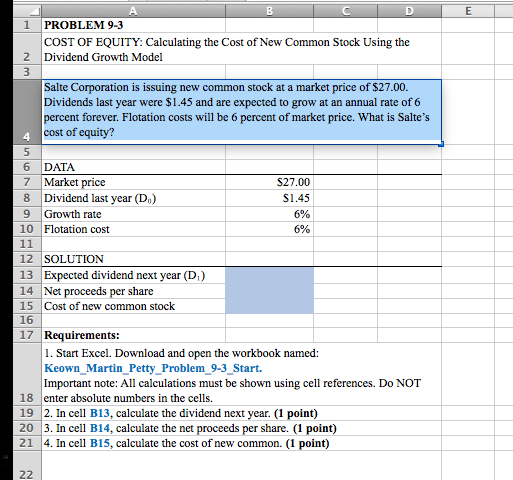

Question: For problem 9-3 find the expected dividend next year (D), net proceeds per share, and cost of new common stock as shown on B13, B14,

For problem 9-3 find the expected dividend next year (D), net proceeds per share, and cost of new common stock as shown on B13, B14, and B15, which are needed to answer the question. provide the formula used to solve each step.

2) Discuss you approach to a sound and meaningful financial statement analysis. Be detailed and specific as to what you would do and what data you would represent. answer MUST be 300 words or more and must answer the questions

3)What is the value to the firm of a well-prepared capital budget? Why do firms need them? answer MUST be 300 words or more and must answer the questions

4)What are the key considerations used by the CFO in determining how to finance the firm's long term investment and asset growth.? explain whether or not interest rates have any impact of these decisions. answer MUST be 300 words or more and must answer the questions

1 PROBLEM 9-3 COST OF EQUITY: Calculating the Cost of New Common Stock Using the Dividend Growth Model 2 Salte Corporation is issuing new common stock at a market price of $27.00 Dividends last year were $1.45 and are expected to grow at an annual rate of 6 percent forever. Flotation costs will be 6 percent of market price. What is Salte's cost of equity? 4 6 DATA 7 Market price 8 Dividend last year (Do) 9 Growth rate 10 Flotation cost $27.00 $1.45 6% 6% 12 SOLUTION 13 Expected dividend next year (D) 14 Net proceeds per share 15 Cost of new common stock 16 17 Requirements: 1. Start Excel. Download and open the workbook named: Keown Martin_Petty_Problem 9-3_Start. Important note: All calculations must be shown using cell references. Do NOT 18 enter absolute numbers in the cells 19 2. In cell B13, calculate the dividend next year. (1 point) 20 3. In cell B14, calculate the net proceeds per share. (1 point) 21 4. In cell B15, calculate the cost of new common. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts