Question: For problems 1, 2, 3 and 4 consider a market con- 3. Assume that if two firms merge, the merged firm will be able to

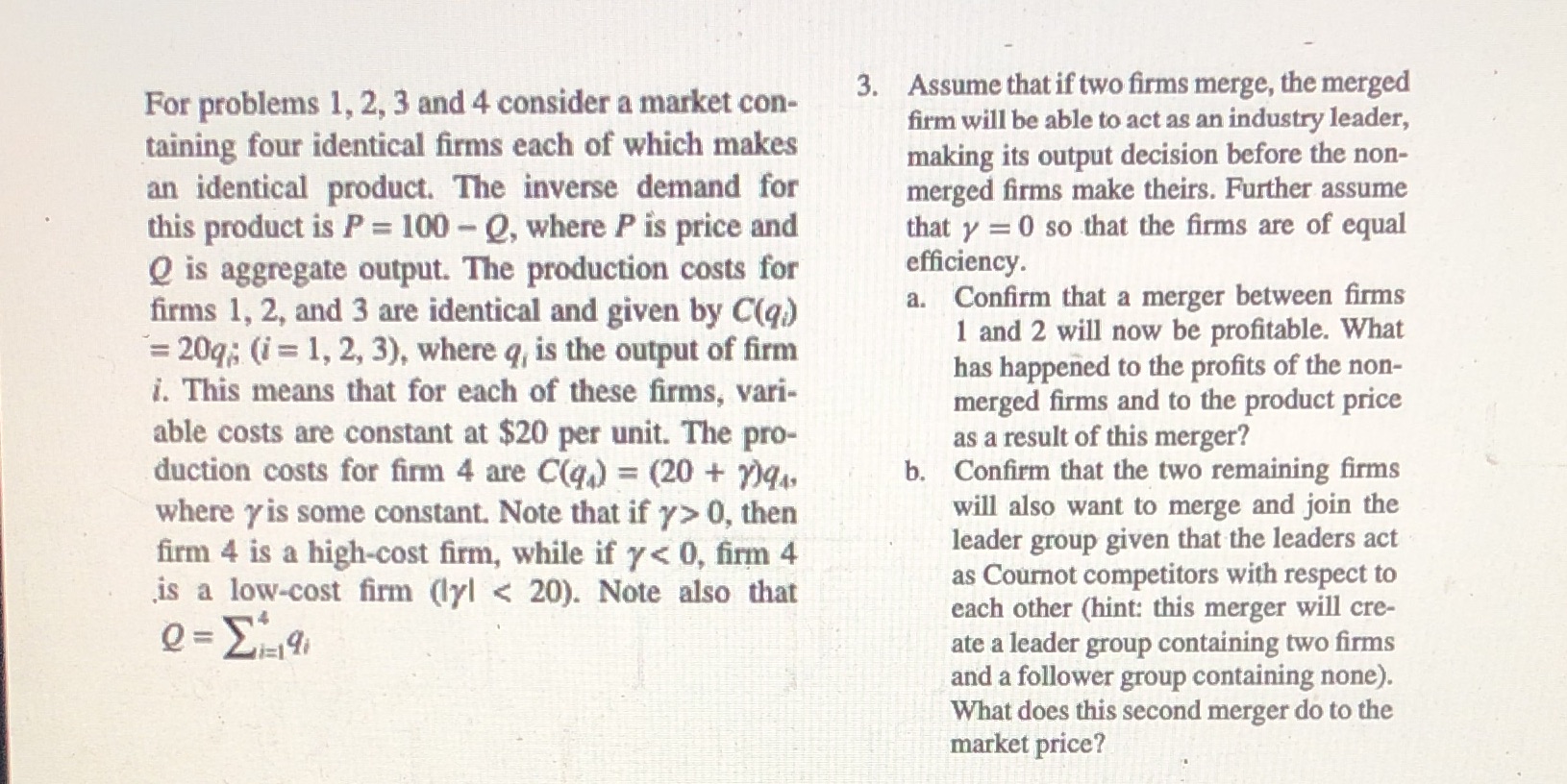

For problems 1, 2, 3 and 4 consider a market con- 3. Assume that if two firms merge, the merged firm will be able to act as an industry leader, taining four identical firms each of which makes making its output decision before the non- an identical product. The inverse demand for merged firms make theirs. Further assume this product is P = 100 - Q, where P is price and that y =0 so that the firms are of equal Q is aggregate output. The production costs for efficiency. firms 1, 2, and 3 are identical and given by C(q)) a. Confirm that a merger between firms = 20q; (i = 1, 2, 3), where q, is the output of firm 1 and 2 will now be profitable. What i. This means that for each of these firms, vari- has happened to the profits of the non- merged firms and to the product price able costs are constant at $20 per unit. The pro- as a result of this merger? duction costs for firm 4 are C(q,) = (20 + 7)q, b. Confirm that the two remaining firms where y is some constant. Note that if y> 0, then will also want to merge and join the firm 4 is a high-cost firm, while if y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts