Question: For problems 5 through 7, you are given the following prices for zero-coupon bonds with each having a maturity value of one: Time to Maturity1

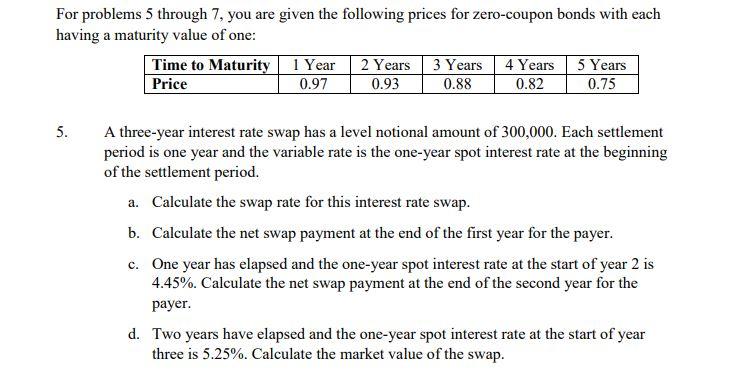

For problems 5 through 7, you are given the following prices for zero-coupon bonds with each having a maturity value of one: Time to Maturity1 Year2 Years3 Years4 Years5 YearsPrice0.970.930.880.820.755.A three-year interest rate swap has a level notional amount of 300,000. Each settlement period is one year and the variable rate is the one-year spot interest rate at the beginning of the settlement period. a. Calculate the swap rate for this interest rate swap. b. Calculate the net swap payment at the end of the first year for the payer. c. One year has elapsed and the one-year spot interest rate at the start of year 2 is 4.45%. Calculate the net swap payment at the end of the second year for the payer. d. Two years have elapsed and the one-year spot interest rate at the start of year three is 5.25%. Calculate the market value of the swap.

For problems 5 through 7, you are given the following prices for zero-coupon bonds with each having a maturity value of one: Time to Maturity 1 Year 2 Years 3 Years 4 Years 5 Years Price 0.97 0.93 0.88 0.82 0.75 5. A three-year interest rate swap has a level notional amount of 300,000. Each settlement period is one year and the variable rate is the one-year spot interest rate at the beginning of the settlement period. a. Calculate the swap rate for this interest rate swap. b. Calculate the net swap payment at the end of the first year for the payer. c. One year has elapsed and the one-year spot interest rate at the start of year 2 is 4.45%. Calculate the net swap payment at the end of the second year for the payer. d. Two years have elapsed and the one-year spot interest rate at the start of year three is 5.25%. Calculate the market value of the swap. For problems 5 through 7, you are given the following prices for zero-coupon bonds with each having a maturity value of one: Time to Maturity 1 Year 2 Years 3 Years 4 Years 5 Years Price 0.97 0.93 0.88 0.82 0.75 5. A three-year interest rate swap has a level notional amount of 300,000. Each settlement period is one year and the variable rate is the one-year spot interest rate at the beginning of the settlement period. a. Calculate the swap rate for this interest rate swap. b. Calculate the net swap payment at the end of the first year for the payer. c. One year has elapsed and the one-year spot interest rate at the start of year 2 is 4.45%. Calculate the net swap payment at the end of the second year for the payer. d. Two years have elapsed and the one-year spot interest rate at the start of year three is 5.25%. Calculate the market value of the swap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts