Question: For Problems 5.3 and 5.4. The following projects are utilized in Problems 5.3 and 5.4. Projects A and B are indepen- dent. Projects C and

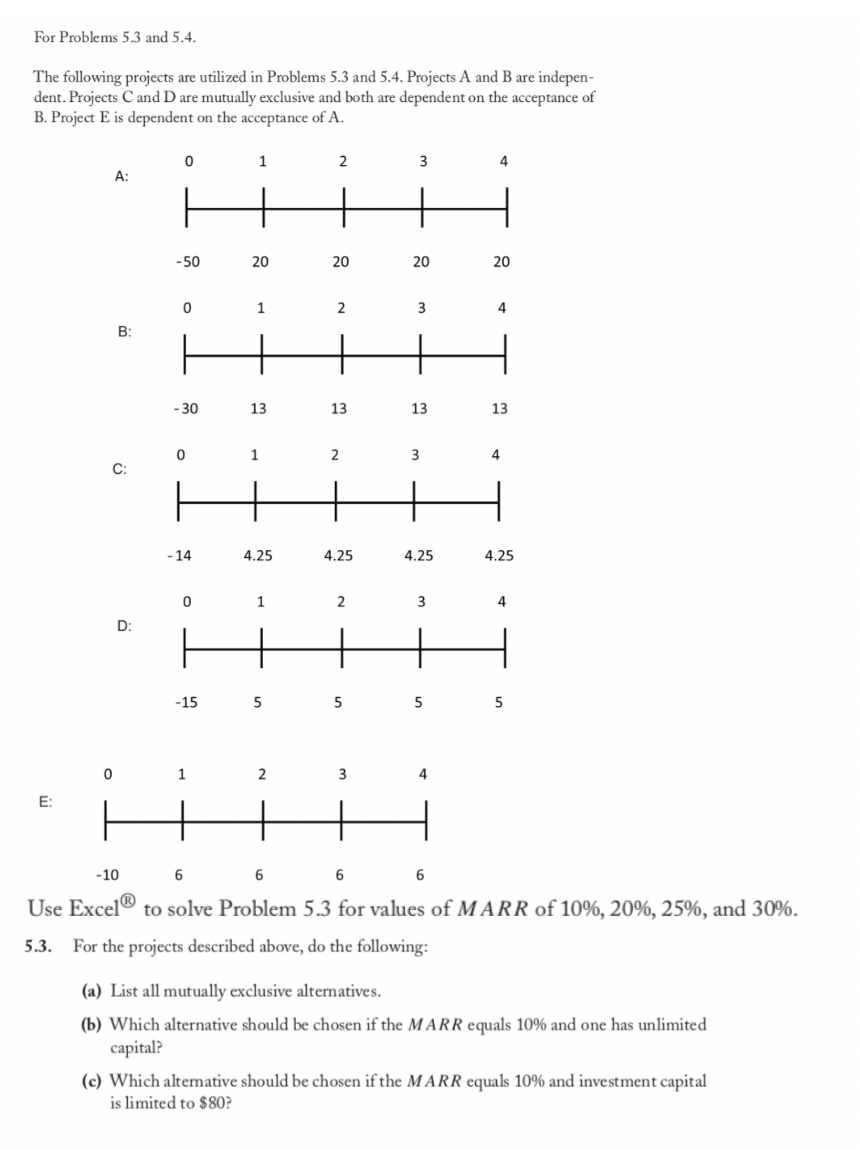

For Problems 5.3 and 5.4. The following projects are utilized in Problems 5.3 and 5.4. Projects A and B are indepen- dent. Projects C and D are mutually exclusive and both are dependent on the acceptance of B. Project E is dependent on the acceptance of A. 0 1 1 2 3 4 A: T -50 20 20 20 20 T HHHH - -30 13 13 13 0 1 2 3 HHHH -14 4.25 4.25 4.25 13 4 + 1 4.25 = D: HHHH -15 5 5 5 5 EHHHH -10 6 6 6 6 Use Excel to solve Problem 5.3 for values of MARR of 10%, 20%, 25%, and 30%. 5.3. For the projects described above, do the following: (a) List all mutually exclusive alternatives. (b) Which alternative should be chosen if the MARR equals 10% and one has unlimited capital? (c) Which alternative should be chosen if the MARR equals 10% and investment capital is limited to $80? For Problems 5.3 and 5.4. The following projects are utilized in Problems 5.3 and 5.4. Projects A and B are indepen- dent. Projects C and D are mutually exclusive and both are dependent on the acceptance of B. Project E is dependent on the acceptance of A. 0 1 1 2 3 4 A: T -50 20 20 20 20 T HHHH - -30 13 13 13 0 1 2 3 HHHH -14 4.25 4.25 4.25 13 4 + 1 4.25 = D: HHHH -15 5 5 5 5 EHHHH -10 6 6 6 6 Use Excel to solve Problem 5.3 for values of MARR of 10%, 20%, 25%, and 30%. 5.3. For the projects described above, do the following: (a) List all mutually exclusive alternatives. (b) Which alternative should be chosen if the MARR equals 10% and one has unlimited capital? (c) Which alternative should be chosen if the MARR equals 10% and investment capital is limited to $80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts