Question: For question 1 & 2: Is the question asking for 1.Net Present Value of each and individual acquire/develop/selling price; or 2. overall net present value

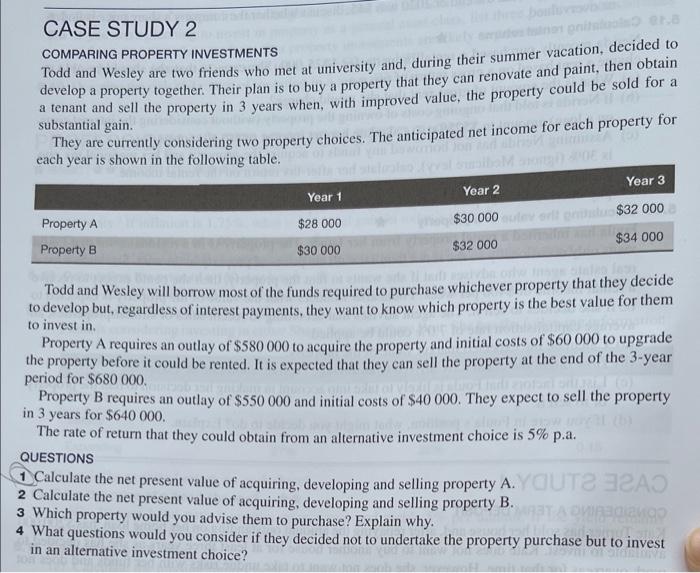

CASE STUDY 2 COMPARING PROPERTY INVESTMENTS Todd and Wesley are two friends who met at university and during their summer vacation, decided to develop a property together. Their plan is to buy a property that they can renovate and paint , then obtain a tenant and sell the property in 3 years when, with improved value, the property could be sold for a substantial gain. They are currently considering two property choices. The anticipated net income for each property for each year is shown in the following table. Year 3 Year 2 Year 1 $32 000 $34 000 Property A $28 000 $30 000 Property B $30 000 $32 000 Todd and Wesley will borrow most of the funds required to purchase whichever property that they decide to develop but, regardless of interest payments, they want to know which property is the best value for them to invest in Property A requires an outlay of $580 000 to acquire the property and initial costs of $60 000 to upgrade the property before it could be rented. It is expected that they can sell the property at the end of the 3-year period for $680 000 Property B requires an outlay of $550 000 and initial costs of $40 000. They expect to sell the property in 3 years for $640 000 The rate of return that they could obtain from an alternative investment choice is 5% p.a. QUESTIONS 1 Calculate the net present value of acquiring, developing and selling property A. OUT EAO 2 Calculate the net present value of acquiring, developing and selling property B. 3 Which property would you advise them to purchase? Explain why. DVD 4 What questions would you consider if they decided not to undertake the property purchase but to invest in an alternative investment choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts