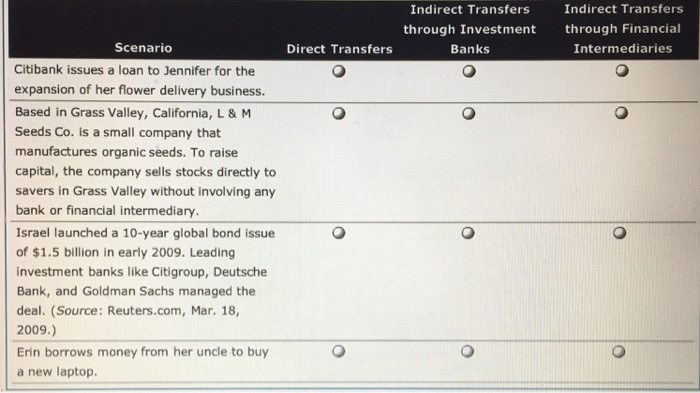

Question: For question 1A, in the table below please correctly identify the nature of the capital transfer given in the scenario with its appropriate classification. 1.

1. Capital allocation process Aa Aa The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial intermediaries, companies, mutual funds, and other market participants. In a developed market economy, capital flows freely between entities that want to supply capital to those who want it. This flow of capital can be clssified in three ways. In the table below, identify the nature of capital transfer given in the scenario with its appropriate classification: Indirect Transfers through Investment Banks Indirect Transfers through Financial Intermediaries Scenario Direct Transfers Citibank issues a loan to Jennifer for the expansion of her flower delivery business. Based in Grass Valley, California, L &M Seeds Co. is a small company that manufactures organic seeds. To raise capital, the company sells stocks directly to savers in Grass Valley without involving any bank or financial intermediary. Israel launched a 10-year global bond issue of $1.5 billion in early 2009. Leading investment banks like Citigroup, Deutsche Bank, and Goldman Sachs managed the deal. (Source: Reuters.com, Mar. 18, 2009.) Erin borrows money from her uncle to buy a new laptop

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts