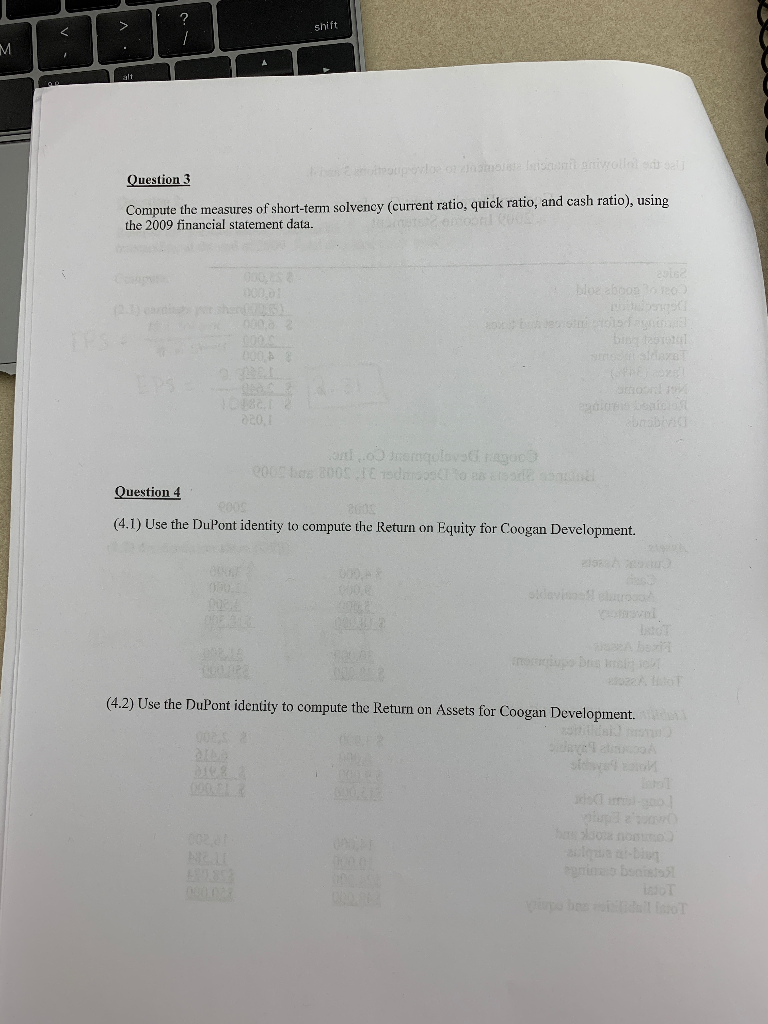

Question: For question 3 and 4 First, write the formula Second, substitute the number into the formula Third, say what is left to compute Fourth, compute

For question 3 and 4

First, write the formula

Second, substitute the number into the formula

Third, say what is left to compute

Fourth, compute

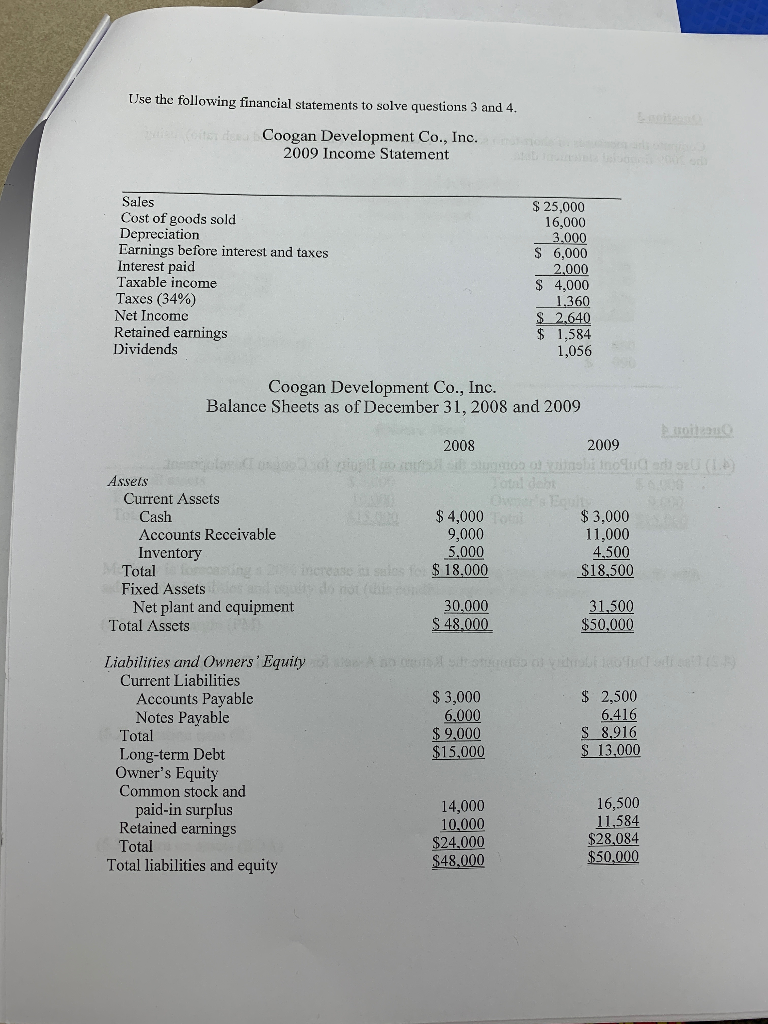

Use the following financial statements to solve questions 3 and 4. Coogan Development Co., Inc. 2009 Income Statement Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (34%) Net Income Retained earnings Dividends $ 25,000 16,000 3.000 $ 6,000 2.000 $ 4,000 1.360 $ 2.640 $ 1,584 1,056 Coogan Development Co., Inc. Balance Sheets as of December 31, 2008 and 2009 Botas 2008 2009 art Assets Current Assets Cash Accounts Receivable Inventory Total Fixed Assets Net plant and equipment Total Assets $ 4,000 9,000 5.000 $ 18.000 $3,000 11,000 4,500 $18,500 30,000 $ 48.000 31,500 $50,000 $3,000 6.000 $ 9,000 $15,000 $ 2,500 6.416 S 8,916 $ 13,000 Liabilities and Owners' Equity Current Liabilities Accounts Payable Notes Payable Total Long-term Debt Owner's Equity Common stock and paid-in surplus Retained earnings Total Total liabilities and equity 14,000 10,000 $24,000 16,500 11,584 $28,084 $50,000 $48.000 shift Question 3 Compute the measures of short-term solvency (current ratio, quick ratio, and cash ratio), using the 2009 financial statement data. Og bil 2002 angolo 2001 Todos os Question 4 (4.1) Use the DuPont identity to compute the Return on Equity for Coogan Development. 300 Sidovi po be Rot (4.2) Use the DuPont identity to compute the Return on Assets for Coogan Development. Site SOT OT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts