Question: for question 3 You may use your book, notes, etc. Exam is worth 35% of your grade (with take-home part). All questions are weighted equally

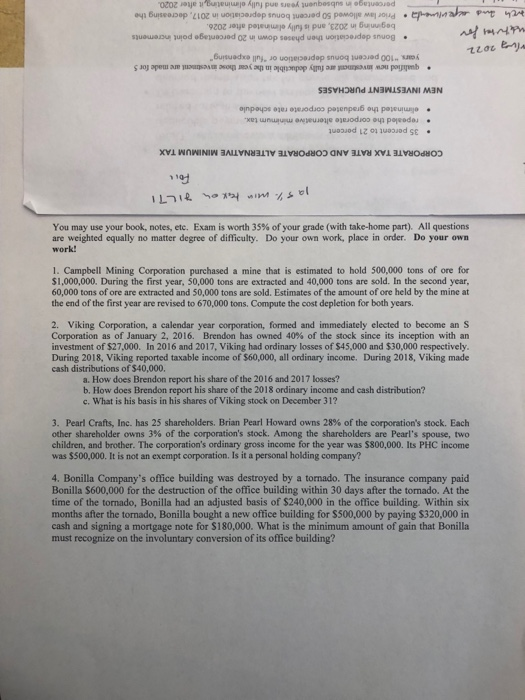

You may use your book, notes, etc. Exam is worth 35% of your grade (with take-home part). All questions are weighted equally no matter degree of difficulty. Do your own work, place in order. Do your own work! 1. Campbell Mining Corporation purchased a mine that is estimated to hold 500,000 tons of ore for $1,000,000. During the first year, 50,000 tons are extracted and 40,000 tons are sold. In the second year 60,000 tons of ore are extracted and 50,000 tons are sold. Estimates of the amount of ore held by the mine at the end of the first year are revised to 670,000 tons. Compute the cost depletion for both years. 2. Viking Corporation, a calendar year corporation, formed and immediately elected to become an S Corporation as of January 2, 2016, Brendon has owned 40% of the stock since its inception with an investment of $27,000. In 2016 and 2017, Viking had ordinary losses of $45,000 and $30,000 respectively During 2018, Viking reported taxable income of $60,000, all ordinary income. During 2018, Viking made cash distributions of $40,000, a. How does Brendon report his share of the 2016 and 2017 losses? b. How does Brendon report his share of the 2018 ordinary income and cash distribution? c. What is his basis in his shares of Viking stock on December 31? 3. Pearl Crafts, Inc. has 25 shareholders. Brian Pearl Howard owns 28% of the corporation's stock. Each other shareholder owns 3% of the corporation's stock. Among the shareholders are Pearl's spouse, two children, and brother. The corporation's ordinary gross income for the year was $800,000. Its PHC income was $500,000. It is not an exempt corporation. Is it a personal holding company? 4. Bonilla Company's office building was destroyed by a tornado. The insurance company paid Bonilla $600,000 for the destruction of the office building within 30 days after the tornado. At the time of the tornado, Bonilla had an adjusted basis of $240,000 in the office building. Within six months after the tornado, Bonilla bought a new office building for $500,000 by paying $320,000 in cash and signing a mortgage note for $180,000. What is the minimum amount of gain that Bonilla must recognize on the involuntary conversion of its office building

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts