Question: For Question 41 - Question 46: Suppose the S&R index is 1000 and the dividend yield is zero. The continuously compounded borrowing rate is 5%

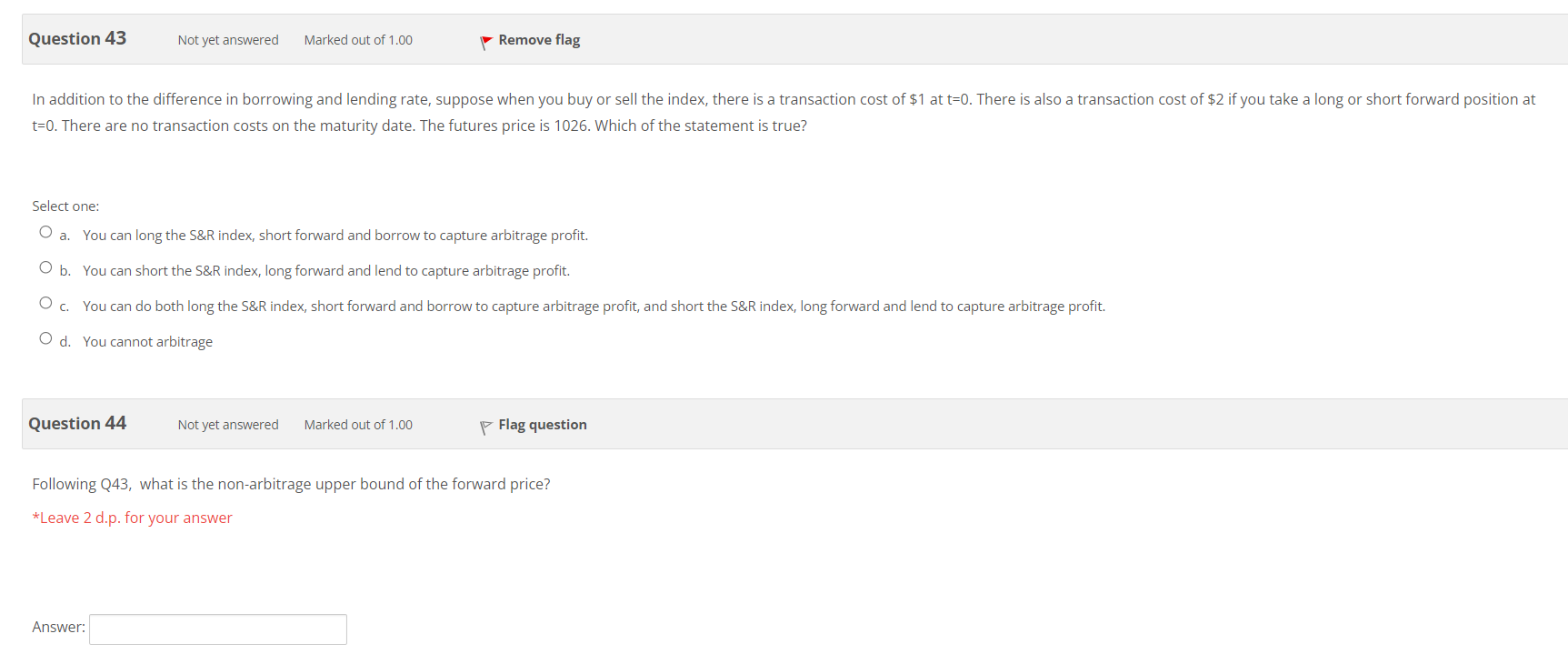

For Question 41 - Question 46: Suppose the S&R index is 1000 and the dividend yield is zero. The continuously compounded borrowing rate is 5% p.a. while the continuously compounded lending rate is 4.5% p.a.. The maturity of the forward contract is 6 months. Question 43 Not yet answered Marked out of 1.00 Remove flag In addition to the difference in borrowing and lending rate, suppose when you buy or sell the index, there is a transaction cost of $1 at t=0. There is also a transaction cost of $2 if you take a long or short forward position at t=0. There are no transaction costs on the maturity date. The futures price is 1026. Which of the statement is true? Select one: a. You can long the S&R index, short forward and borrow to capture arbitrage profit. O b. You can short the S&R index, long forward and lend to capture arbitrage profit. Oc. You can do both long the S&R index, short forward and borrow to capture arbitrage profit, and short the S&R index, long forward and lend to capture arbitrage profit. O d. You cannot arbitrage Question 44 Not yet answered Marked out of 1.00 Flag question Following Q43, what is the non-arbitrage upper bound of the forward price? *Leave 2 d.p. for your answer Answer: For Question 41 - Question 46: Suppose the S&R index is 1000 and the dividend yield is zero. The continuously compounded borrowing rate is 5% p.a. while the continuously compounded lending rate is 4.5% p.a.. The maturity of the forward contract is 6 months. Question 43 Not yet answered Marked out of 1.00 Remove flag In addition to the difference in borrowing and lending rate, suppose when you buy or sell the index, there is a transaction cost of $1 at t=0. There is also a transaction cost of $2 if you take a long or short forward position at t=0. There are no transaction costs on the maturity date. The futures price is 1026. Which of the statement is true? Select one: a. You can long the S&R index, short forward and borrow to capture arbitrage profit. O b. You can short the S&R index, long forward and lend to capture arbitrage profit. Oc. You can do both long the S&R index, short forward and borrow to capture arbitrage profit, and short the S&R index, long forward and lend to capture arbitrage profit. O d. You cannot arbitrage Question 44 Not yet answered Marked out of 1.00 Flag question Following Q43, what is the non-arbitrage upper bound of the forward price? *Leave 2 d.p. for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts