Question: For question b, please look at the following answer as reference. a) Market Value of Equtiy (S) in million = no. of shares outstanding share

For question b, please look at the following answer as reference.

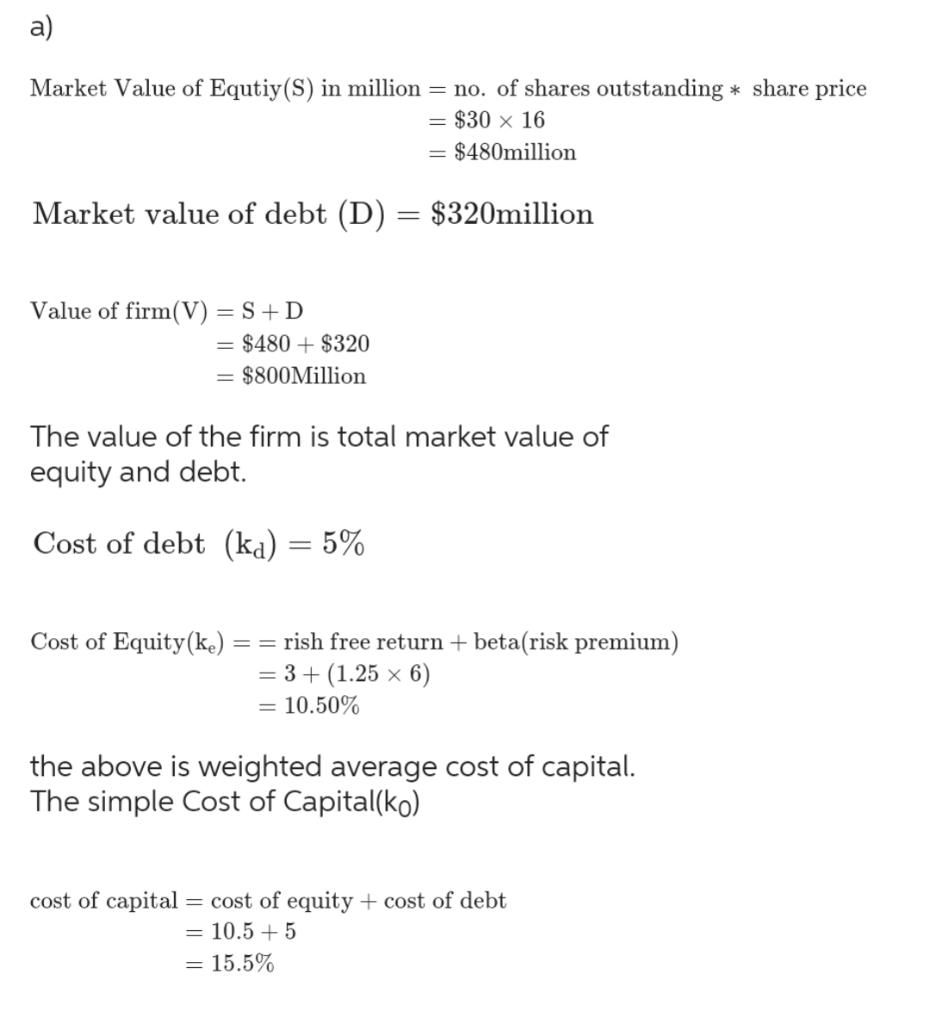

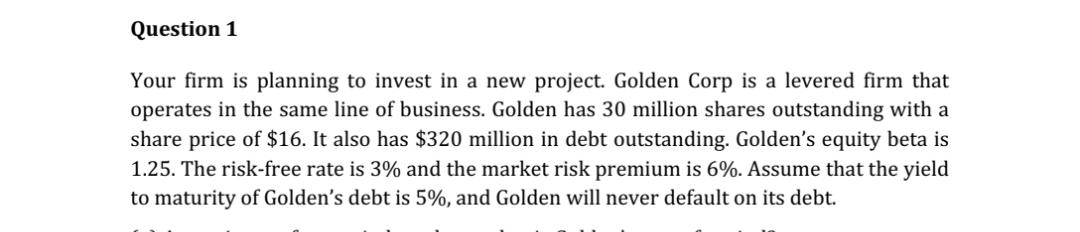

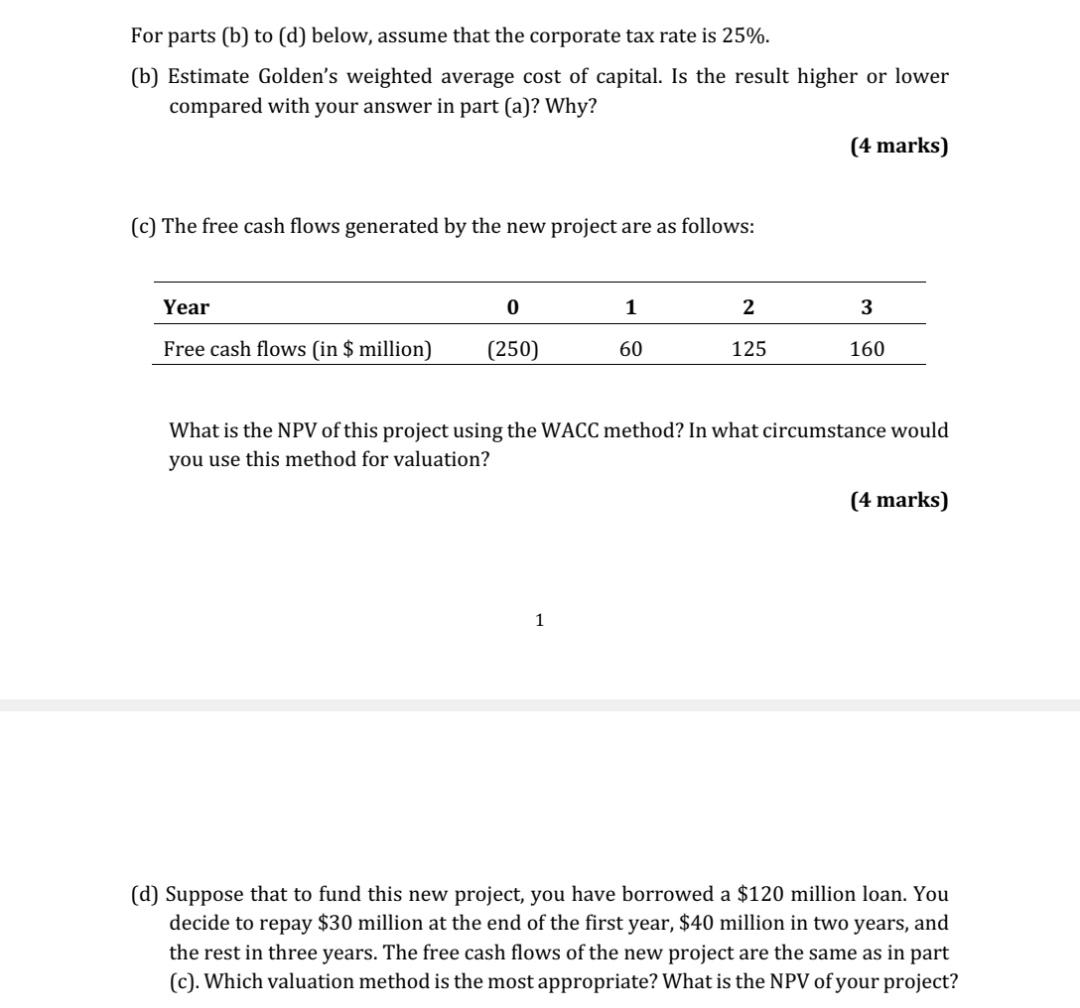

a) Market Value of Equtiy (S) in million = no. of shares outstanding share p =$3016 =$480million Market value of debt(D)=$320 million Value of firm(V)=S+D =$480+$320=$800Million The value of the firm is total market value of equity and debt. Cost of debt (kd)=5% Cost of Equity (ke)== rish free return + beta(risk premium) =3+(1.256)=10.50% the above is weighted average cost of capital. The simple Cost of Capital( k0) cost of capital = cost of equity + cost of debt =10.5+5=15.5% Your firm is planning to invest in a new project. Golden Corp is a levered firm that operates in the same line of business. Golden has 30 million shares outstanding with a share price of $16. It also has $320 million in debt outstanding. Golden's equity beta is 1.25. The risk-free rate is 3% and the market risk premium is 6%. Assume that the yield to maturity of Golden's debt is 5%, and Golden will never default on its debt. For parts (b) to (d) below, assume that the corporate tax rate is 25%. (b) Estimate Golden's weighted average cost of capital. Is the result higher or lower compared with your answer in part (a)? Why? (4 marks) (c) The free cash flows generated by the new project are as follows: What is the NPV of this project using the WACC method? In what circumstance would you use this method for valuation? (4 marks) 1 (d) Suppose that to fund this new project, you have borrowed a $120 million loan. You decide to repay $30 million at the end of the first year, $40 million in two years, and the rest in three years. The free cash flows of the new project are the same as in part (c). Which valuation method is the most appropriate? What is the NPV of your project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts