Question: For question ( d ) , trail balance, ALL accounts shown must be used.Introductory Financial Accounting Individual Assignment 1 ( Deadline: 1 9 Oct 2

For question d trail balance, ALL accounts shown must be used.Introductory Financial Accounting

Individual Assignment Deadline: Oct Sat

This assignment is to achieve the following Course Intended Learning Outcomes:

CILO: illustrate the use of an accounting system as a system of information for decision making.

CILO: capture economic events through the use of the complete accounting cycle, from analysing economic events to preparing financial statements.

Question

Liz started her own consulting firm, Liz Consulting Co on Dec During December, the following transactions were completed.

Dec Shareholders invested $ cash in the business in exchange for ordinary shares.

Paid $ cash on oneyear insurance policy effective Dec

Purchased supplies for $ on account.

Purchased equipment for $ paying $ cash down payment and issued a month note payable for the remaining balance.

Received $ cash from a customer, in advance for the consulting services to be performed later.

Billed other customers $ for construction services performed, receiving $ cash with the rest on account.

Paid $ for employee salaries.

Collected from customers billed on Dec in full.

Billed customers $ for construction services performed.

Paid $ for Dec's rent expense.

Paid the amount owed for supplies purchased on Dec.

Declared dividend of $ to be paid in January

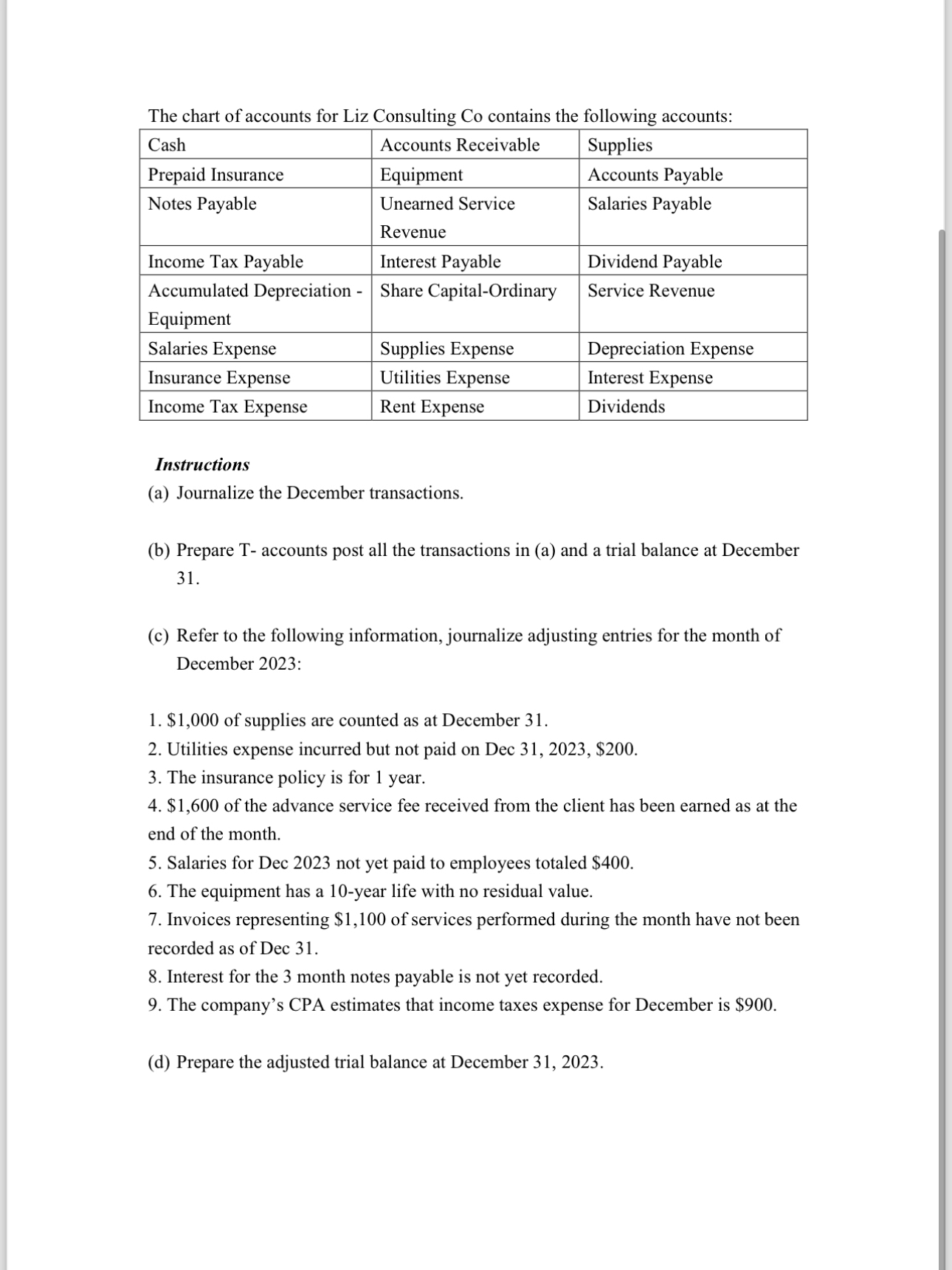

The chart of accounts for Liz Consulting Co contains the following accounts:

tableCashAccounts Receivable,SuppliesPrepaid Insurance,Equipment,Accounts PayableNotes Payable,tableUnearned ServiceRevenueSalaries PayableIncome Tax Payable,Interest Payable,Dividend PayabletableAccumulated Depreciation EquipmentShare CapitalOrdinary,Service RevenueSalaries Expense,Supplies Expense,Depreciation ExpenseInsurance Expense,Utilities Expense,Interest ExpenseIncome Tax Expense,Rent Expense,Dividends

Instructions

a Journalize the December transactions.

b Prepare T accounts post all the transactions in a and a trial balance at December

c Refer to the following information, journalize adjusting entries for the month of December :

$ of supplies are counted as at December

Utilities expense incurred but not paid on Dec $

The insurance policy is for year.

$ of the advance service fee received from the client has been earned as at the end of the month.

Salaries for Dec not yet paid to employees totaled $

The equipment has a year life with no residual value.

Invoices representing $ of services performed during the month have not been recorded as of Dec

Interest for the month notes payable is not yet recorded.

The company's CPA estimates that income taxes expense for December is $

d Prepare the adjusted trial balance at December The credit and debit balance should be $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock