Question: for question with dropdowns 1. 82000/92400/50400/33600 2.120960/201600/84000/80640 3. posion pill/ a proxy/ a takeover/ dilution 4. proxy/ preemptive right 5.75600/100800/101800/151200 1. Rights and privileges of

for question with dropdowns

1. 82000/92400/50400/33600

2.120960/201600/84000/80640

3. posion pill/ a proxy/ a takeover/ dilution

4. proxy/ preemptive right

5.75600/100800/101800/151200

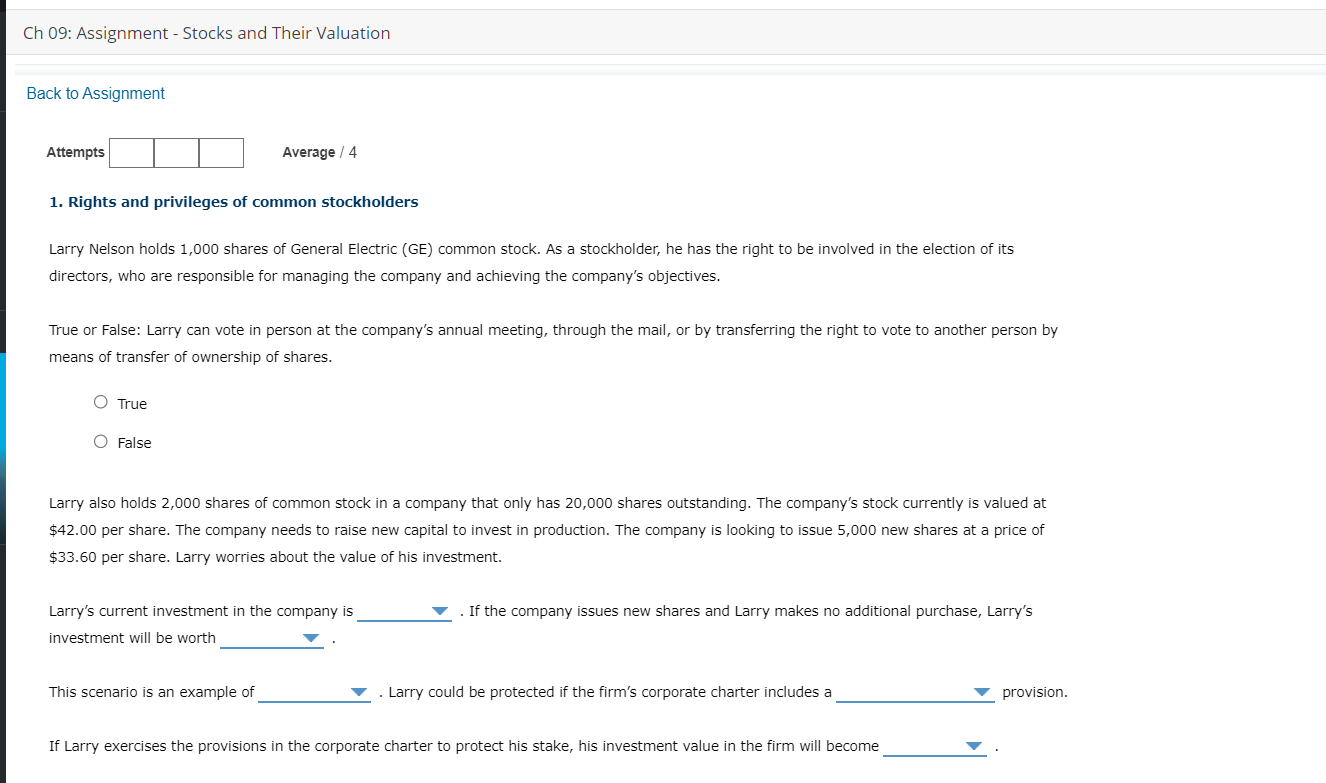

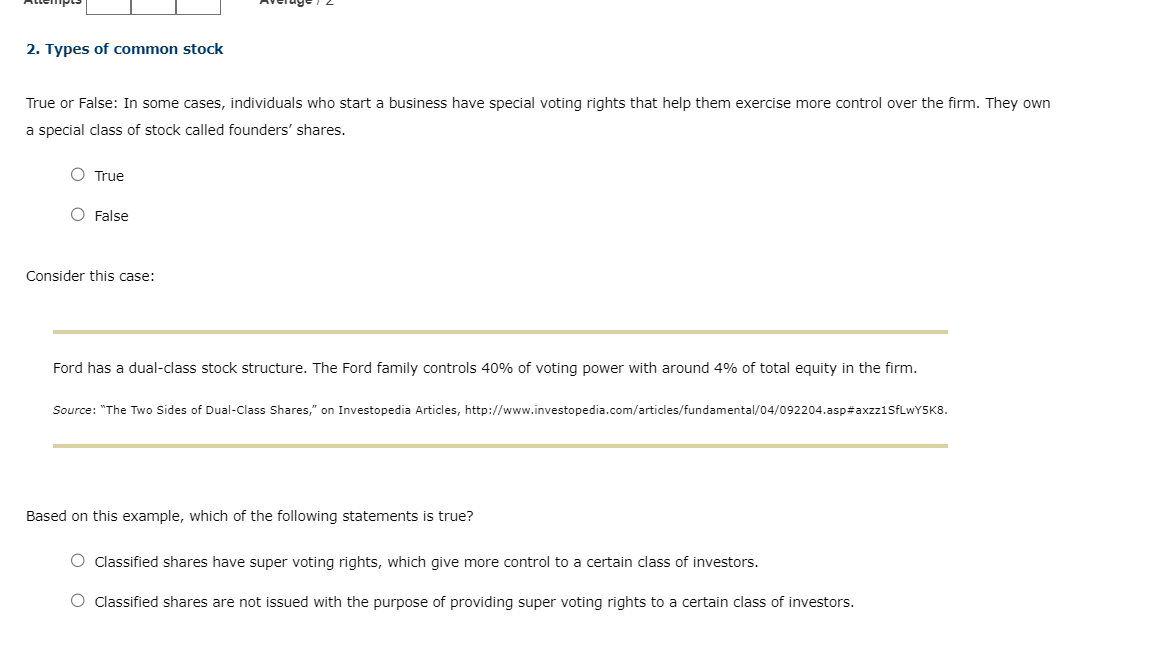

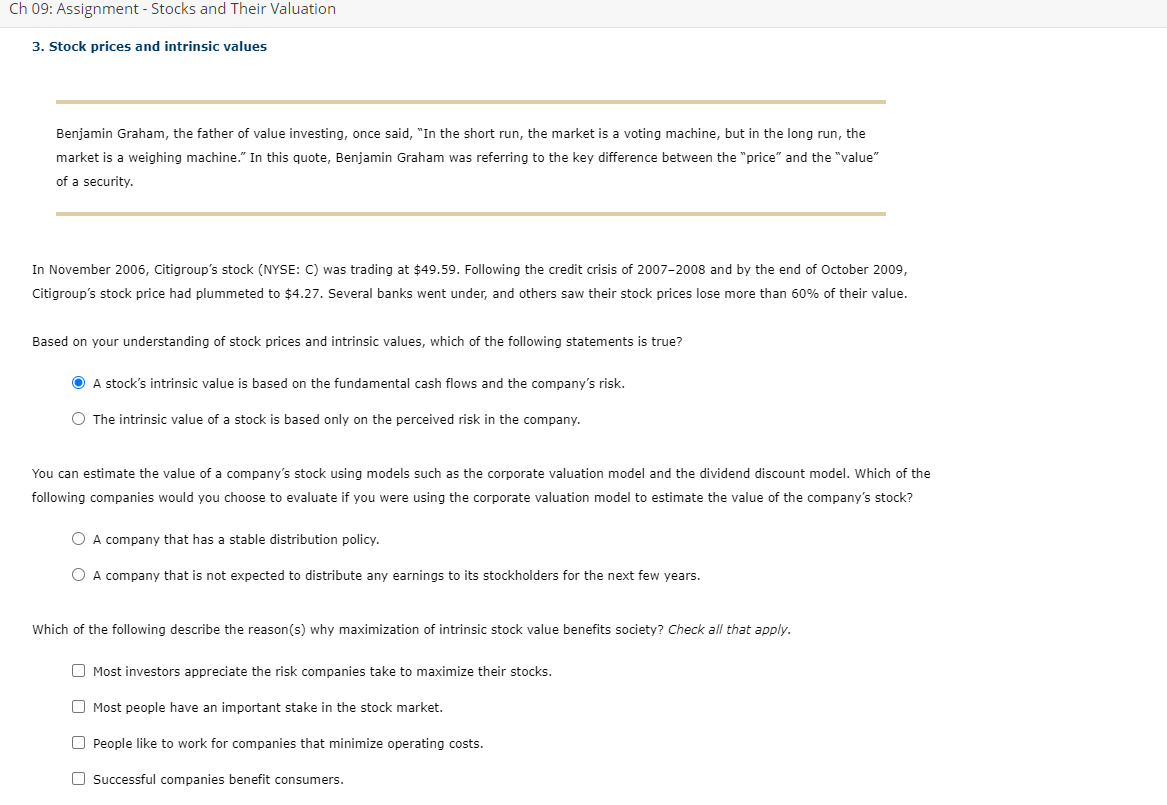

1. Rights and privileges of common stockholders Larry Nelson holds 1,000 shares of General Electric (GE) common stock. As a stockholder, he has the right to be involved in the election of its directors, who are responsible for managing the company and achieving the company's objectives. True or False: Larry can vote in person at the company's annual meeting, through the mail, or by transferring the right to vote to another person by means of transfer of ownership of shares. True False $42.00 per share. The company needs to raise new capital to invest in production. The company is looking to issue 5,000 new shares at a price of $33.60 per share. Larry worries about the value of his investment. Larry's current investment in the company is . If the company issues new shares and Larry makes no additional purchase, Larry's investment will be worth This scenario is an example of . Larry could be protected if the firm's corporate charter includes a provision. If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will become True or False: In some cases, individuals who start a business have special voting rights that help them exercise more control over the firm. They own a special class of stock called founders' shares. True False Consider this case: Ford has a dual-class stock structure. The Ford family controls 40% of voting power with around 4% of total equity in the firm. Source: "The Two Sides of Dual-Class Shares," on Investopedia Articles, http://www.investopedia.com/articles/fundamental/04/092204.asp\#axzz1SfLwY5K8. Based on this example, which of the following statements is true? Classified shares have super voting rights, which give more control to a certain class of investors. Classified shares are not issued with the purpose of providing super voting rights to a certain class of investors. 3. Stock prices and intrinsic values Benjamin Graham, the father of value investing, once said, "In the short run, the market is a voting machine, but in the long run, the market is a weighing machine." In this quote, Benjamin Graham was referring to the key difference between the "price" and the "value" of a security. In November 2006, Citigroup's stock (NYSE: C) was trading at $49.59. Following the credit crisis of 2007-2008 and by the end of October 2009, Based on your understanding of stock prices and intrinsic values, which of the following statements is true? A stock's intrinsic value is based on the fundamental cash flows and the company's risk. The intrinsic value of a stock is based only on the perceived risk in the company. following companies would you choose to evaluate if you were using the corporate valuation model to estimate the value the A company that has a stable distribution policy. A company that is not expected to distribute any earnings to its stockholders for the next few years. Which of the following describe the reason(s) why maximization of intrinsic stock value benefits society? Check all that apply. Most investors appreciate the risk companies take to maximize their stocks. Most people have an important stake in the stock market. People like to work for companies that minimize operating costs. Successful companies benefit consumers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts