Question: for question23 why the answer is c.41.8% for question 28, why the answer is b Question 23 Answer the following question based on the following

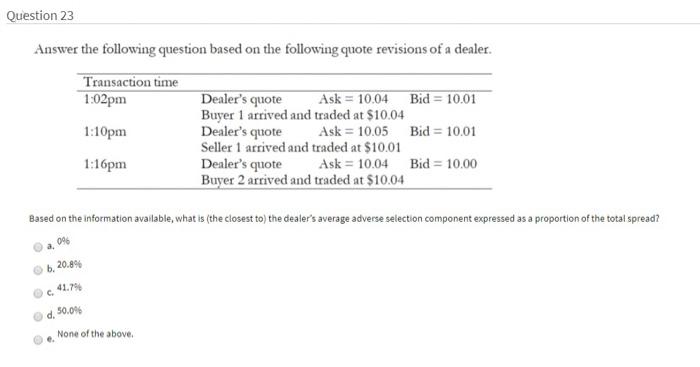

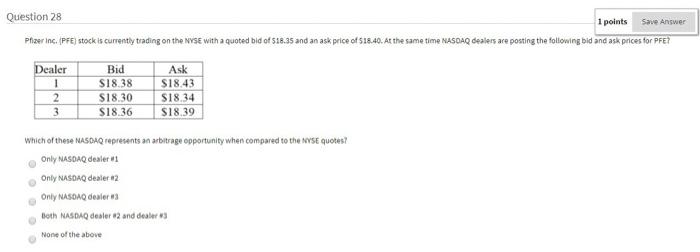

Question 23 Answer the following question based on the following quote revisions of a dealer. Transaction time 1:02 pm 1:10 pm 1:16pm Dealer's quote Ask = 10.04 Bid = 10.01 Buyer 1 arrived and traded at $10.04 Dealer's quote Ask = 10.05 Bid = 10.01 Seller 1 arrived and traded at $10.01 Dealer's quote Ask = 10.04 Bid = 10.00 Buyer 2 arrived and traded at $10.04 Based on the information available, what is (the closest to) the dealer's average adverse selection component expressed as a proportion of the total spread? 09 b. 20.89 41.794 d. 50.0% None of the above Save Answer Question 28 1 points Pfizer Inc. (PFE) stock is currently trading on the Nyse with a quoted bid of 18.35 and an ask price of $18.40. At the same time NASDAQ dealers are posting the following bid and ask prices for PFE? Dealer 1 2 3 Bid S18.38 S18 30 $18.36 Ask $18.43 S18.34 18.39 Which of these NASDAQ represents an arbitrage opportunity when compared to the nose quotes? Only NASDAQ dealer Only NASDAQ dealer 2 Only NASDAQ dealer Both NASDAQ desler 82 and dealers None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts