Question: For questions 46, solve for the future value at the end of the sequence of interest rate terms based on the information provided. For questions

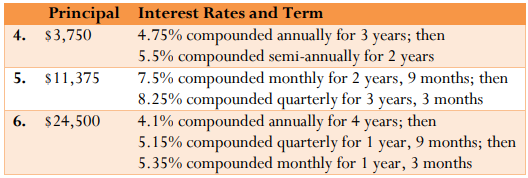

For questions 46, solve for the future value at the end of the sequence of interest rate terms based on the information provided.

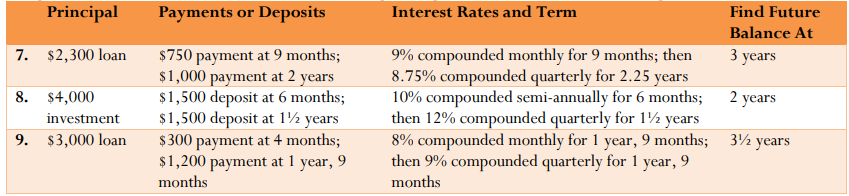

For questions 79, solve for the future value at the time period specified based on the information provided

16. A product manager wants to understand the impact of inflation on her gross profit margin. Inflation is expected to remain constant at 3.5% per year for the next five years. The price of the product is expected to remain unchanged at $99.99 over the five years and the current cost of the product today is $59. a. On a per-unit basis, in what dollar amount is the markup reduced after five years? b. What percent change does this represent in the gross profit margin?

17. The Teachers Association just negotiated a four-year contract for its members, who will receive a 3.5% wage increase immediately followed by annual increases of 3.75%, 4.25%, and 4.1% on the anniversaries of the agreement. In the final year of the contract, how much more would the human resources manager for the school division need to budget for salaries if the average teacher currently earns $72,000 per year and the division employs 34 teachers?

\begin{tabular}{|lll|} \hline & Principal & Interest Rates and Term \\ \hline 4. $3,750 & 4.75% compounded annually for 3 years; then \\ & & 5.5% compounded semi-annually for 2 years \\ \hline 5. $11,375 & 7.5% compounded monthly for 2 years, 9 months; then \\ & & 8.25% compounded quarterly for 3 years, 3 months \\ \hline 6. $24,500 & 4.1% compounded annually for 4 years; then \\ & & 5.15% compounded quarterly for 1 year, 9 months; then \\ & & 5.35% compounded monthly for 1 year, 3 months \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts