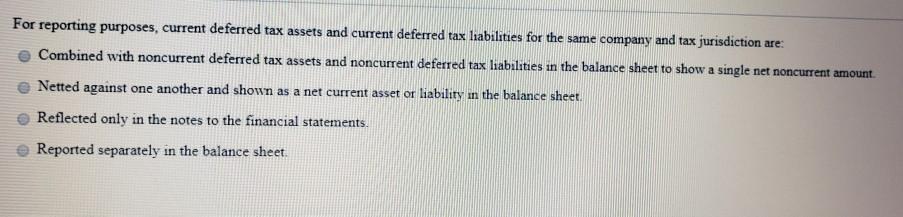

Question: For reporting purposes, current deferred tax assets and current deferred tax liabilities for the same company and tax jurisdiction are: Combined with noncurrent deferred

For reporting purposes, current deferred tax assets and current deferred tax liabilities for the same company and tax jurisdiction are: Combined with noncurrent deferred tax assets and noncurrent deferred tax liabilities in the balance sheet to show a single net noncurrent amount. Netted against one another and shown as a net current asset or liability in the balance sheet. Reflected only in the notes to the financial statements. O Reported separately in the balance sheet.

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Ans Option2 Netted Against one another and Shown as net Current Asset or Liability in ... View full answer

Get step-by-step solutions from verified subject matter experts