Question: for same problem previously i calculated thr net sales to be 297930 and gross profit to be 134750 Check my [The following information applies to

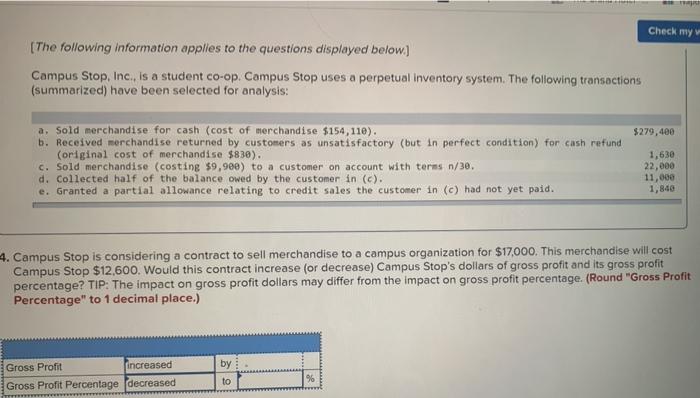

Check my [The following information applies to the questions displayed below.] Campus Stop, Inc., is a student co-op. Campus Stop uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: $279,400 a. Sold merchandise for cash (cost of merchandise $154,110). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $830). c. Sold merchandise (costing $9,90e) to a customer on account with terms n/30 d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. 1,630 22,000 11,000 1,840 4. Campus Stop is considering a contract to sell merchandise to a campus organization for $17,000. This merchandise will cost Campus Stop $12,600. Would this contract increase for decrease) Campus Stop's dollars of gross profit and its gross profit percentage? TIP: The impact on gross profit dollars may differ from the impact on gross profit percentage. (Round "Gross Profit Percentage" to 1 decimal place.) by Gross Profit increased Gross Profit Percentage decreased to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts