Question: for section it has been told to have a life expectancy of 14 years. a) Mr Bloom, a young professional of 31, wishes to spend

for section it has been told to have a life expectancy of 14 years.

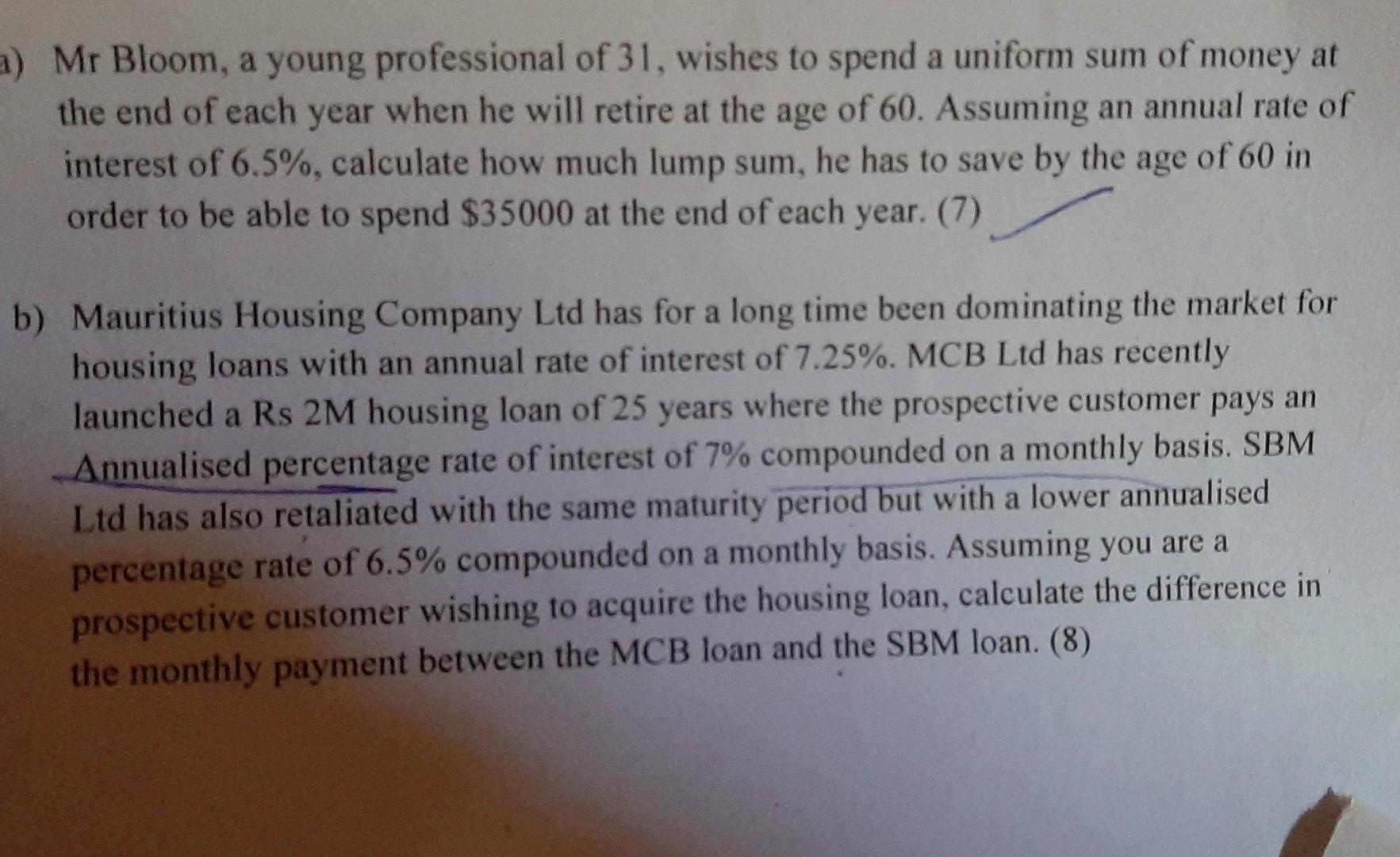

a) Mr Bloom, a young professional of 31, wishes to spend a uniform sum of money at the end of each year when he will retire at the age of 60. Assuming an annual rate of interest of 6.5%, calculate how much lump sum, he has to save by the age of 60 in order to be able to spend $35000 at the end of each year. (7) b) Mauritius Housing Company Ltd has for a long time been dominating the market for housing loans with an annual rate of interest of 7.25%. MCB Ltd has recently launched a Rs 2M housing loan of 25 years where the prospective customer pays an Annualised percentage rate of interest of 7% compounded on a monthly basis. SBM Ltd has also retaliated with the same maturity period but with a lower annualised percentage rate of 6.5% compounded on a monthly basis. Assuming you are a prospective customer wishing to acquire the housing loan, calculate the difference in the monthly payment between the MCB loan and the SBM loan. (8)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts