Question: For simplicity, suppose all four banks have the same leverage ratio of L before the negative shocked happened. Please answer the questions below. i.

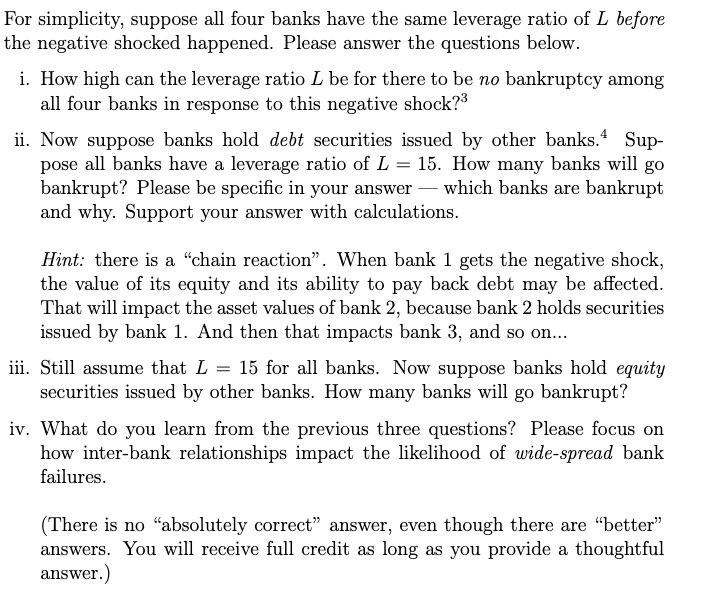

For simplicity, suppose all four banks have the same leverage ratio of L before the negative shocked happened. Please answer the questions below. i. How high can the leverage ratio L be for there to be no bankruptcy among all four banks in response to this negative shock? ii. Now suppose banks hold debt securities issued by other banks. Sup- pose all banks have a leverage ratio of L = 15. How many banks will go bankrupt? Please be specific in your answer which banks are bankrupt and why. Support your answer with calculations. Hint: there is a "chain reaction". When bank 1 gets the negative shock, the value of its equity and its ability to pay back debt may be affected. That will impact the asset values of bank 2, because bank 2 holds securities issued by bank 1. And then that impacts bank 3, and so on... iii. Still assume that L = 15 for all banks. Now suppose banks hold equity securities issued by other banks. How many banks will go bankrupt? iv. What do you learn from the previous three questions? Please focus on how inter-bank relationships impact the likelihood of wide-spread bank failures. (There is no "absolutely correct" answer, even though there are "better" answers. You will receive full credit as long as you provide a thoughtful answer.)

Step by Step Solution

There are 3 Steps involved in it

i To prevent bankruptcy among all four banks in response to the negative shock the leverage ratio L ... View full answer

Get step-by-step solutions from verified subject matter experts