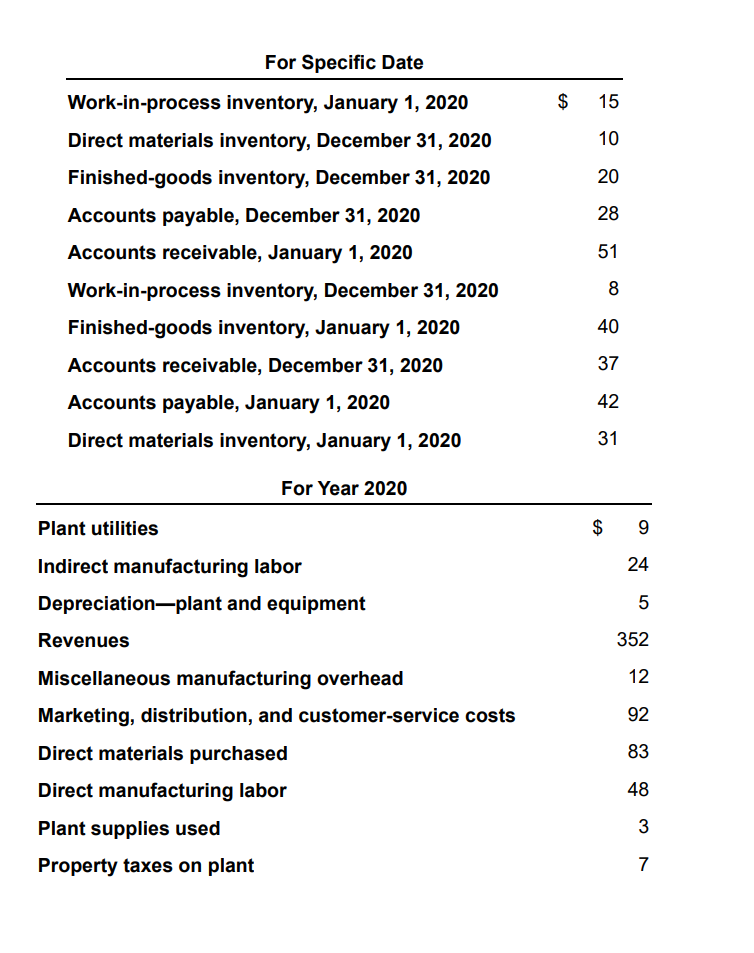

Question: For Specific Date Work-in-process inventory, January 1, 2020 Direct materials inventory, December 31, 2020 Finished-goods inventory, December 31, 2020 Accounts payable, December 31, 2020 Accounts

For Specific Date Work-in-process inventory, January 1, 2020 Direct materials inventory, December 31, 2020 Finished-goods inventory, December 31, 2020 Accounts payable, December 31, 2020 Accounts receivable, January 1, 2020 Work-in-process inventory, December 31, 2020 Finished-goods inventory, January 1, 2020 Accounts receivable, December 31, 2020 Accounts payable, January 1, 2020 Direct materials inventory, January 1, 2020 $15 10 20 28 51 8 40 37 42 31 For Year 2020 Plant utilities $9 Indirect manufacturing labor 24 Depreciation-plant and equipment 5 Revenues 352 Miscellaneous manufacturing overhead 12 Marketing, distribution, and customer-service costs 92 Direct materials purchased 83 Direct manufacturing labor 48 Plant supplies used 3 Property taxes on plant 7 Chan's manufacturing costing system uses a three-part classification of direct materials, direct manufacturing labor, and manufacturing overhead costs. The following items (in millions) pertain to Chan Corporation: (Click the icon to view the items.) Requirement Prepare an income statement and a supporting schedule of cost of goods manufactured. Begin by preparing the supporting schedule of cost of goods manufactured (in millions). Start with the direct materials and direct labor costs, then indirect manufacturing costs, and complete the schedule by calculating cost of goods manufactured. For Specific Date Work-in-process inventory, January 1, 2020 Direct materials inventory, December 31, 2020 Finished-goods inventory, December 31, 2020 Accounts payable, December 31, 2020 Accounts receivable, January 1, 2020 Work-in-process inventory, December 31, 2020 Finished-goods inventory, January 1, 2020 Accounts receivable, December 31, 2020 Accounts payable, January 1, 2020 Direct materials inventory, January 1, 2020 $15 10 20 28 51 8 40 37 42 31 For Year 2020 Plant utilities $9 Indirect manufacturing labor 24 Depreciation-plant and equipment 5 Revenues 352 Miscellaneous manufacturing overhead 12 Marketing, distribution, and customer-service costs 92 Direct materials purchased 83 Direct manufacturing labor 48 Plant supplies used 3 Property taxes on plant 7 Chan's manufacturing costing system uses a three-part classification of direct materials, direct manufacturing labor, and manufacturing overhead costs. The following items (in millions) pertain to Chan Corporation: (Click the icon to view the items.) Requirement Prepare an income statement and a supporting schedule of cost of goods manufactured. Begin by preparing the supporting schedule of cost of goods manufactured (in millions). Start with the direct materials and direct labor costs, then indirect manufacturing costs, and complete the schedule by calculating cost of goods manufactured

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts