Question: For Studying: Adjusting Entries Part of this course involves being able to visualize and complete the accounting cycle. This first question challenges you in this

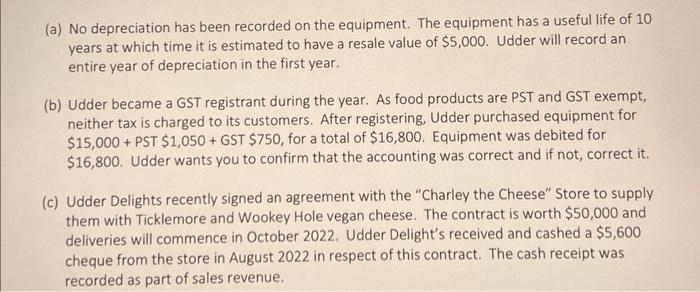

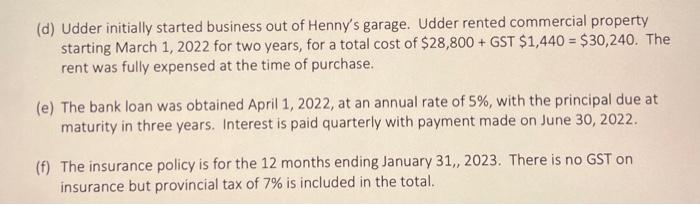

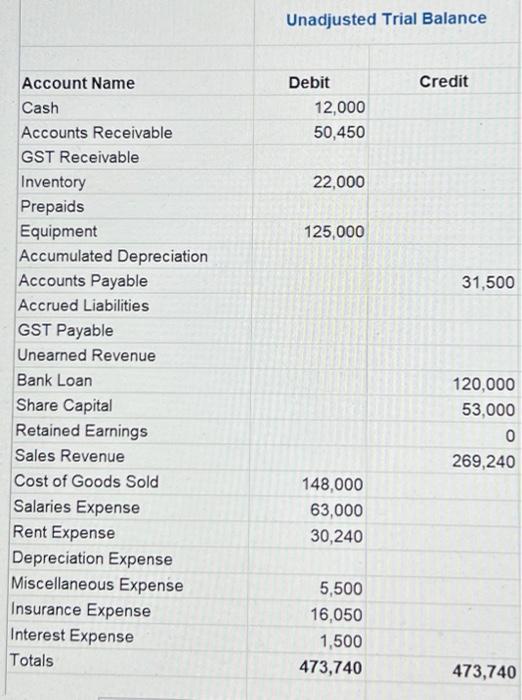

Part of this course involves being able to visualize and complete the accounting cycle. This first question challenges you in this regard. You may need to review your Introductory Accounting textbookotes. The process, logic and terminology associated with the accounting cycle will be used regularly throughout this course, so it is important to not only complete this question but also to understand what is happening. You are the accountant with Udder Delights Inc. (UD) which is a new company that sells vegan cheese products, which is a competitive and growing industry. The business is owned and operated by Henny Bovine. Henny has been so busy that they haven't had any time to complete their Financial Statements as of and for the year ended August 31, 2022. Henny's bank manager has threatened to cancel Udder Delight's bank loan (due in approximately two years from now) if it does not receive an Income Statement showing the company's gross profit and net income by next week. Henny started to make adjustments and corrections but simply ran out of time. Henny assembled the attached worksheet and handed you the following information you might need. (a) No depreciation has been recorded on the equipment. The equipment has a useful life of 10 years at which time it is estimated to have a resale value of $5,000. Udder will record an entire year of depreciation in the first year. (b) Udder became a GST registrant during the year. As food products are PST and GST exempt, neither tax is charged to its customers. After registering, Udder purchased equipment for $15,000+ PST $1,050+ GST $750, for a total of $16,800. Equipment was debited for $16,800. Udder wants you to confirm that the accounting was correct and if not, correct it. (c) Udder Delights recently signed an agreement with the "Charley the Cheese" Store to supply them with Ticklemore and Wookey Hole vegan cheese. The contract is worth $50,000 and deliveries will commence in October 2022. Udder Delight's received and cashed a $5,600 cheque from the store in August 2022 in respect of this contract. The cash receipt was recorded as part of sales revenue. (d) Udder initially started business out of Henny's garage. Udder rented commercial property starting March 1, 2022 for two years, for a total cost of $28,800+GST$1,440=$30,240. The rent was fully expensed at the time of purchase. (e) The bank loan was obtained April 1, 2022, at an annual rate of 5%, with the principal due at maturity in three years. Interest is paid quarterly with payment made on June 30,2022. (f) The insurance policy is for the 12 months ending January 31,2023 . There is no GST on insurance but provincial tax of 7% is included in the total. Unadjusted Trial Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts