Question: For Tax Return Problem 106 please fill out Form 1120, and 1125-E on 2019 Forms from IRS.gov. (See Reg. $1.248-1(c); Bay Sound Transportation Co., 1967-2

For Tax Return Problem 106 please fill out Form 1120, and 1125-E on 2019 Forms from IRS.gov.

For Tax Return Problem 106 please fill out Form 1120, and 1125-E on 2019 Forms from IRS.gov.

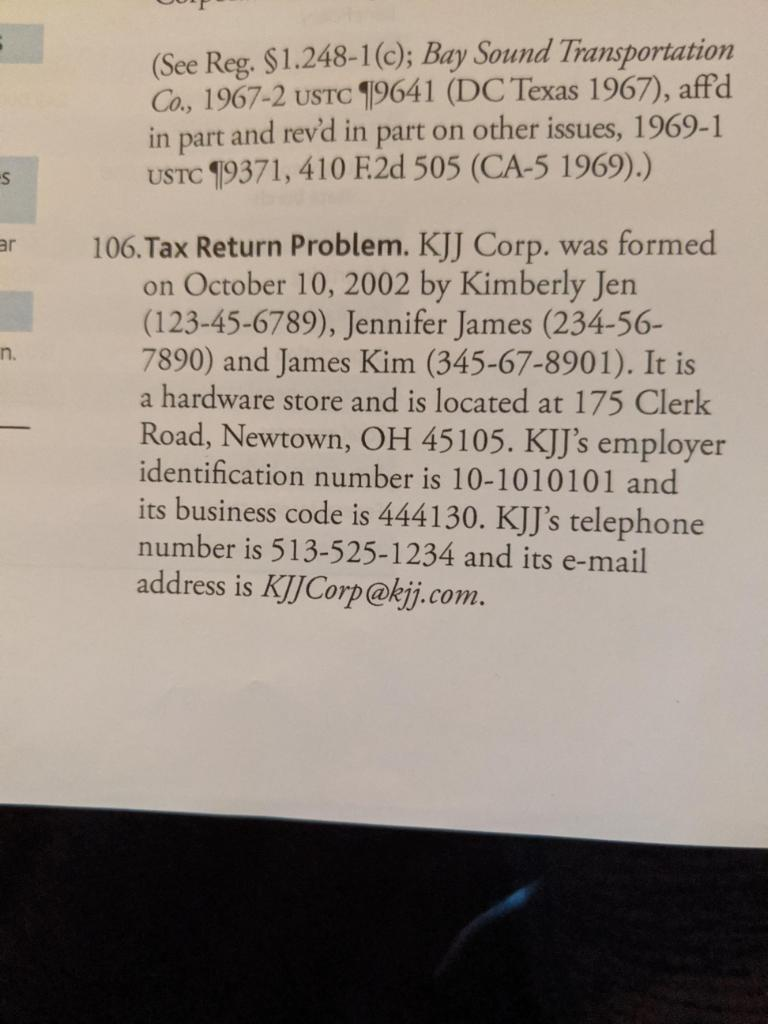

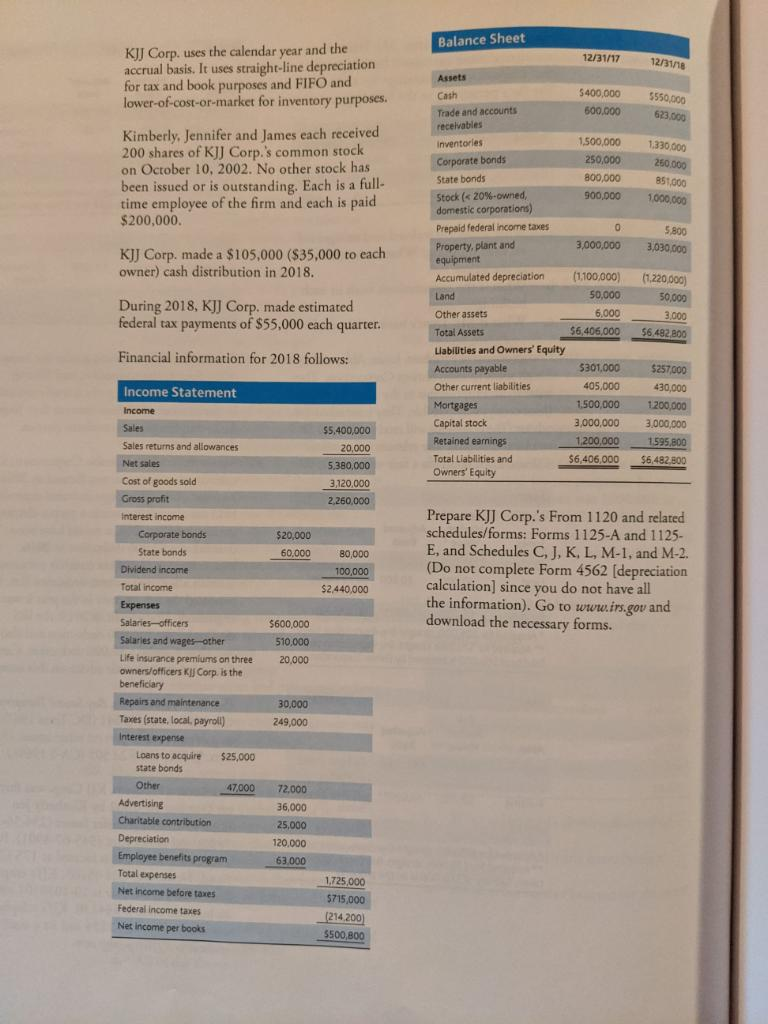

(See Reg. $1.248-1(c); Bay Sound Transportation Co., 1967-2 USTC 9641 (DC Texas 1967), affd in part and rev'd in part on other issues, 1969-1 USTC 99371, 410 F.2d 505 (CA-5 1969).) ar 106. Tax Return Problem. KJJ Corp. was formed on October 10, 2002 by Kimberly Jen (123-45-6789), Jennifer James (234-56- 7890) and James Kim (345-67-8901). It is a hardware store and is located at 175 Clerk Road, Newtown, OH 45105. KJJ's employer identification number is 10-1010101 and its business code is 444130. KJJ's telephone number is 513-525-1234 and its e-mail address is KJJCorp@kj.com. 12/31/18 KJJ Corp. uses the calendar year and the accrual basis. It uses straight-line depreciation for tax and book purposes and FIFO and lower-of-cost-or-market for inventory purposes. 5400,000 $550.000 623.000 1.500,000 Kimberly, Jennifer and James each received 200 shares of KJJ Corp.'s common stock on October 10, 2002. No other stock has been issued or is outstanding. Each is a full- time employee of the firm and each is paid $200,000. 1330,000 280,000 851,000 1.000.000 Balance Sheet 12/31/17 Assets Cash Trade and accounts 600.000 receivables Inventories Corporate bonds 250,000 State bonds 800,000 Stock (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts