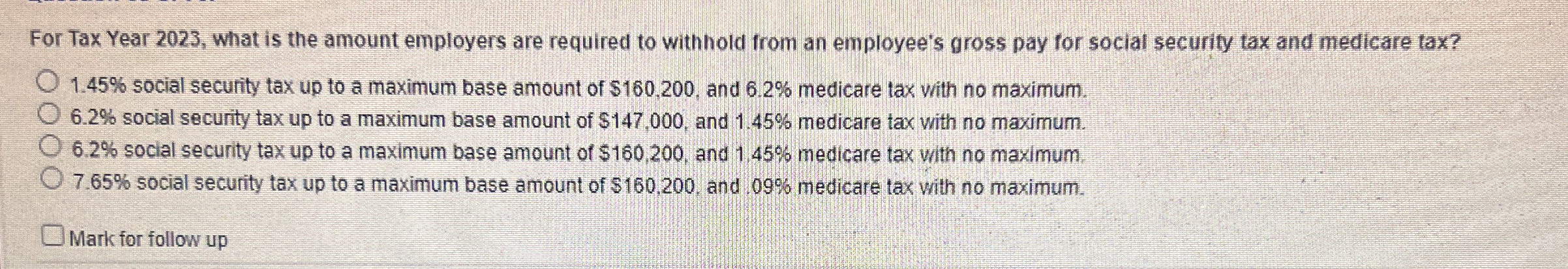

Question: For Tax Year 2 0 2 3 , what is the amount employers are required to withold from an employee's gross pay for social security

For Tax Year what is the amount employers are required to withold from an employee's gross pay for social security tax and medicare tax?

social security tax up to a maximum base amount of $ and medicare tax vith no maximum.

social security tax up to a maximum base amount of $ and medicare tax with no maximum.

social security tax up to a maximum base amount of $ and medicare tax vith no maximum.

social security tax up to a maximum base amount of $ and medicare tax with no maximum.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock