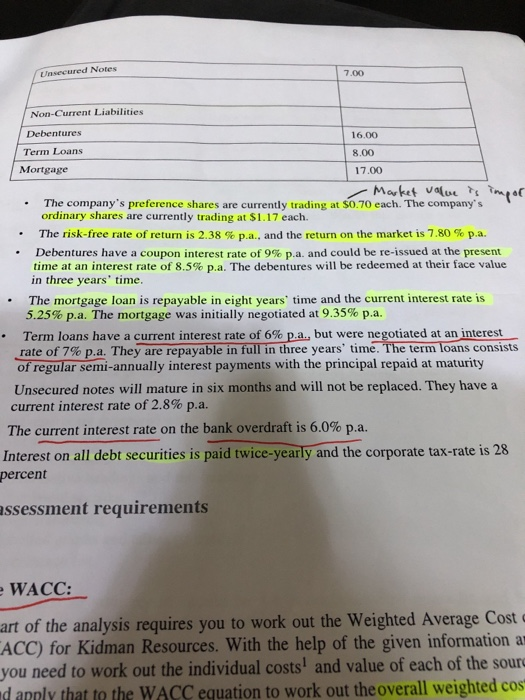

Question: for term loans whats the present value Unsecured Notes 7.00 Non-Current Liabilities Debentures Term Loans 16.00 8.00 17.00 Mortgage Market alue . The company's preference

Unsecured Notes 7.00 Non-Current Liabilities Debentures Term Loans 16.00 8.00 17.00 Mortgage Market alue . The company's preference shares are currently trading at $0.70 each. The company's ordinary shares are currently trading at $1.17 each. The risk-free rate of return is 2.38 % pa, and the return on the market is 7.80% p.a. Debentures have a coupon interest rate of 9% p.a. and could be re-issued at the present time at an interest rate of 8.5% pa. The debentures will be redeemed at their face value in three years' time. The mortgage loan is repayable in eight years' time and the current interest rate is 5.25% pa. The mortgage was initially negotiated at 9.35% p.a. :Term loans have a current interest rate of 6% p.a., but were negotiated at an interest of regular semi-annually interest payments with the principal repaid at maturity Unsecured notes will mature in six months and will not be replaced. They have a rate of 7% pa. They are repayableinfulTnthree years' time. ThetermToans consists current interest rate of 2.8% pa. The current interest rate on the bank overdraft is 6.0% pa. Interest on all debt securities is paid twice-yearly and the corporate tax-rate is 28 percent ssessment requirements WACC: art of the analysis requires you to work out the Weighted Average Cost ACC) for Kidman Resources. With the help of the given information ar you need to work out the individual costs and value of each of the sour d analy that to the WACC equation to work out theoverall weighted cos

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts