Question: For the Above, Please answer the blank and the rest of questions (A-C) with additional parts and work shown. For the Above, Please answer the

For the Above, Please answer the blank and the rest of questions (A-C) with additional parts and work shown.

For the Above, Please answer the blank and the rest of questions (A-C) with additional parts and work shown.

For the Above, Please answer the blank and the rest of questions (A-C and C#2) with additional parts and work shown.

For the Above, Please answer the blank and the rest of questions (A-C and C#2) with additional parts and work shown.

Please answer (A-C) Above

Please answer (A-C) Above

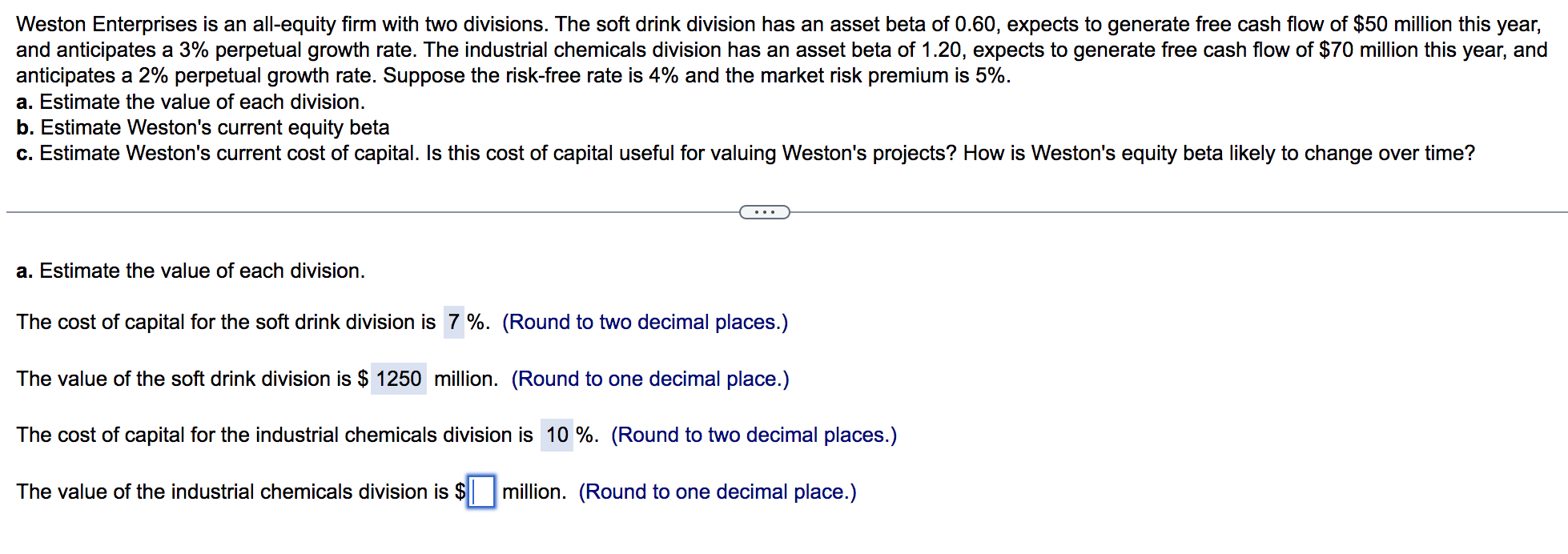

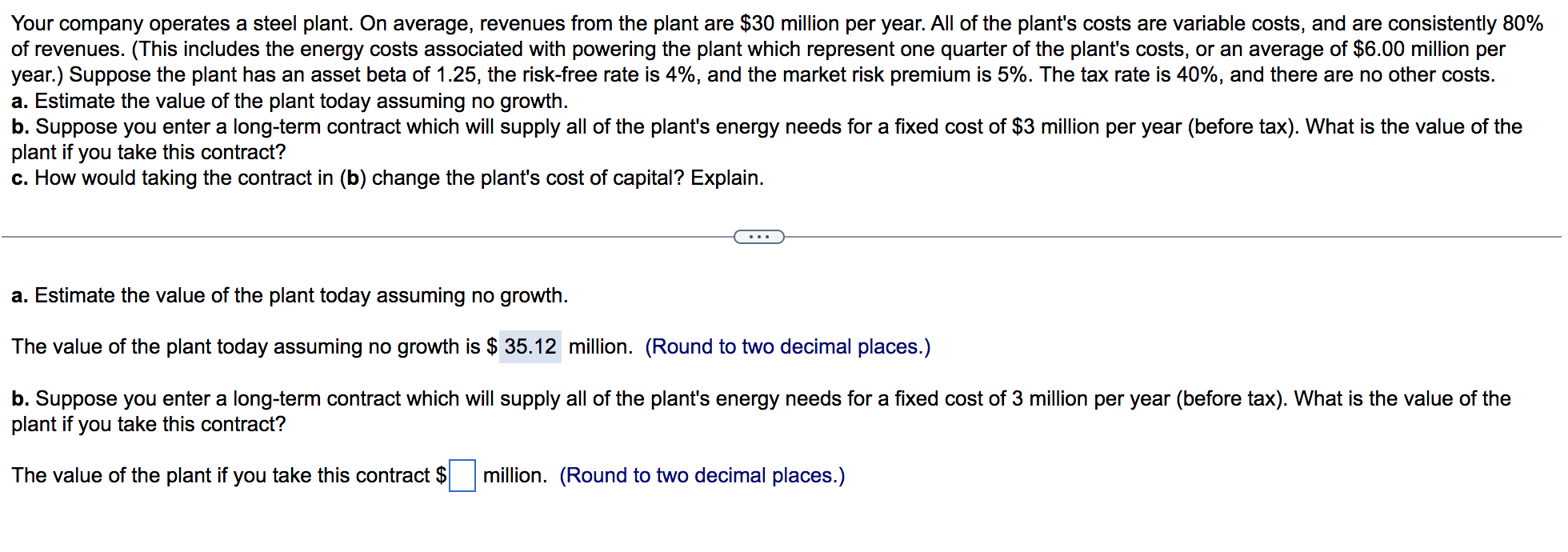

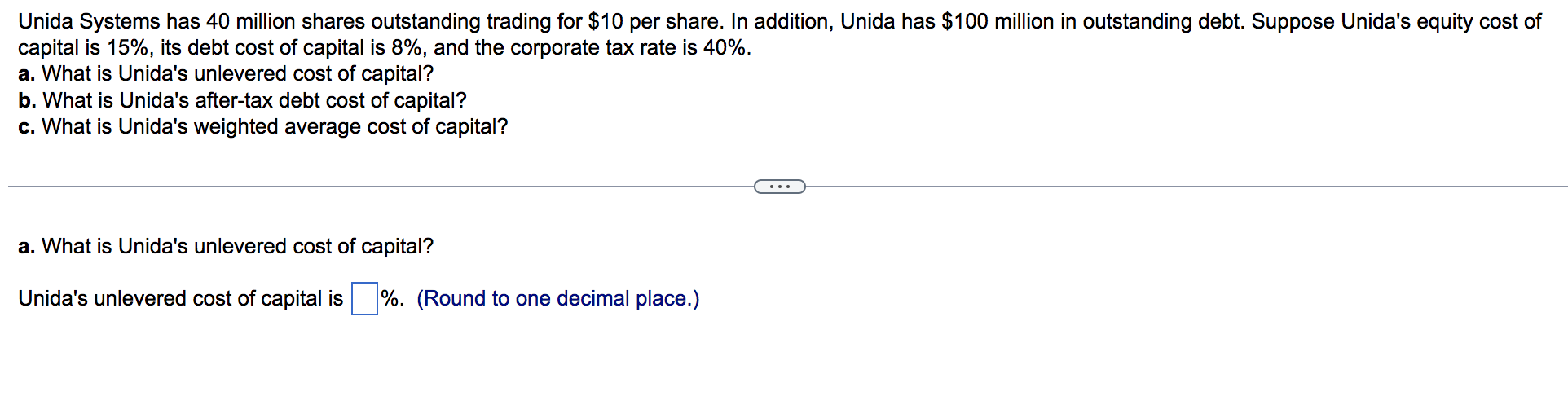

Weston Enterprises is an all-equity firm with two divisions. The soft drink division has an asset beta of 0.60, expects to generate free cash flow of $50 million this year, and anticipates a 3% perpetual growth rate. The industrial chemicals division has an asset beta of 1.20, expects to generate free cash flow of $70 million this year, and anticipates a 2% perpetual growth rate. Suppose the risk-free rate is 4% and the market risk premium is 5%. a. Estimate the value of each division. b. Estimate Weston's current equity beta c. Estimate Weston's current cost of capital. Is this cost of capital useful for valuing Weston's projects? How is Weston's equity beta likely to change over time? a. Estimate the value of each division. The cost of capital for the soft drink division is 7 %. (Round to two decimal places.) The value of the soft drink division is $ 1250 million. (Round to one decimal place.) The cost of capital for the industrial chemicals division is 10 %. (Round to two decimal places.) The value of the industrial chemicals division is $million. (Round to one decimal place.) Your company operates a steel plant. On average, revenues from the plant are $30 million per year. All of the plant's costs are variable costs, and are consistently 80% of revenues. (This includes the energy costs associated with powering the plant which represent one quarter of the plant's costs, or an average of $6.00 million per year.) Suppose the plant has an asset beta of 1.25, the risk-free rate is 4%, and the market risk premium is 5%. The tax rate is 40%, and there are no other costs. a. Estimate the value of the plant today assuming no growth. b. Suppose you enter a long-term contract which will supply all of the plant's energy needs for a fixed cost of $3 million per year (before tax). What is the value of the plant if you take this contract? c. How would taking the contract in (b) change the plant's cost of capital? Explain. a. Estimate the value of the plant today assuming no growth. The value of the plant today assuming no growth is $ 35.12 million. (Round to two decimal places.) b. Suppose you enter a long-term contract which will supply all of the plant's energy needs for a fixed cost of 3 million per year (before tax). What is the value of the plant if you take this contract? The value of the plant if you take this contract $ million. (Round to two decimal places.) Unida Systems has 40 million shares outstanding trading for $10 per share. In addition, Unida has $100 million in outstanding debt. Suppose Unida's equity cost of capital is 15%, its debt cost of capital is 8%, and the corporate tax rate is 40%. a. What is Unida's unlevered cost of capital? b. What is Unida's after-tax debt cost of capital? c. What is Unida's weighted average cost of capital? a. What is Unida's unlevered cost of capital? Unida's unlevered cost of capital is %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts