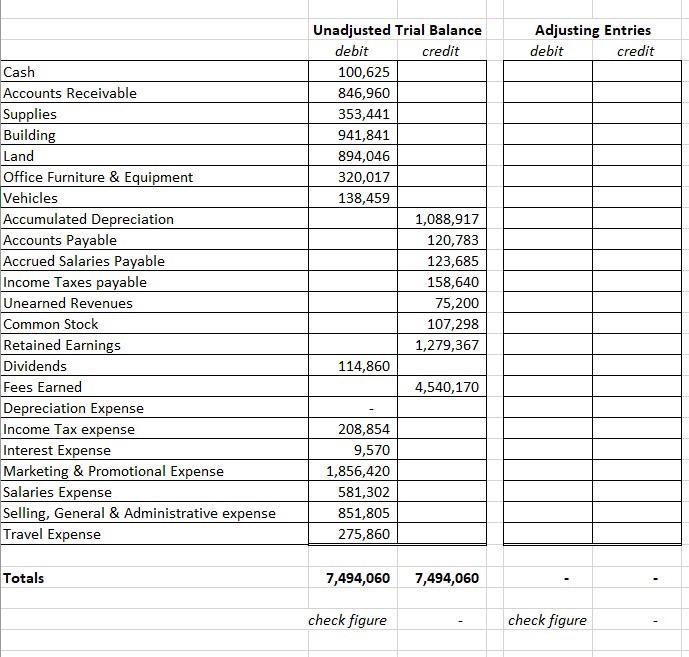

Question: For the adjusted entries, what section & debit or credit , would the following fall under ? 1) depreciation on the building, office equipment, and

For the adjusted entries, what section & debit or credit , would the following fall under ?

1) depreciation on the building, office equipment, and vehicles estimated $75,207

2)Fees earned but not billed are $195,148

3) Salaries earned by employees at the end of the period, to be paid next month, are $71,531

4) Income tax expense for the period are estimated to be $51,980

5) Revenues earned during the period (previously paid for by customers) totaled $50,000

Unadjusted Trial Balance Adjusting Entries debit credit debit credit Cash 100,625 Accounts Receivable Supplies Building Land Office Furniture & Equipment Vehicles Accumulated Depreciation Accounts Payable Accrued Salaries Payable Income Taxes payable Unearned Revenues Common Stock Retained Earnings Dividends Fees Earned Depreciation Expense Income Tax expense Interest Expense Marketing & Promotional Expense Salaries Expense Selling, General & Administrative expense Travel Expense 846,960 353,441 941,841 894,046 320,017 138,459 1,088,917 120,783 123,685 158,640 75,200 107,298 1,279,367 114,860 4,540,170 208,854 9,570 1,856,420 581,302 851,805 275,860 Totals 7,494,060 7,494,060 check figure check figure

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Adjusting Entries Debit Credit Cash Accounts Receivable 195 148 Supplies Building Land Office ... View full answer

Get step-by-step solutions from verified subject matter experts