Question: For the base case in this section, as a percentage of sales, COGS=70 percent, SGA =14 percent, R&D =3.0 percent. Depreciation, Interest expense are fixed

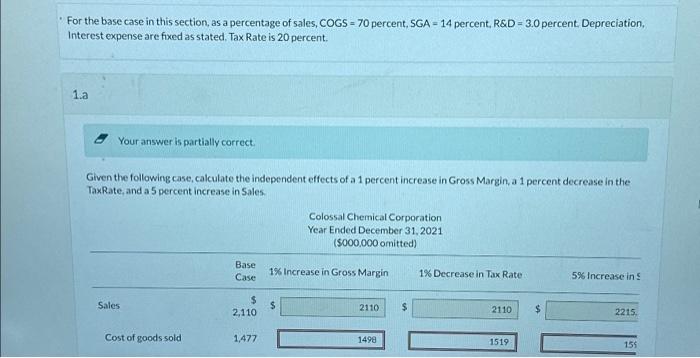

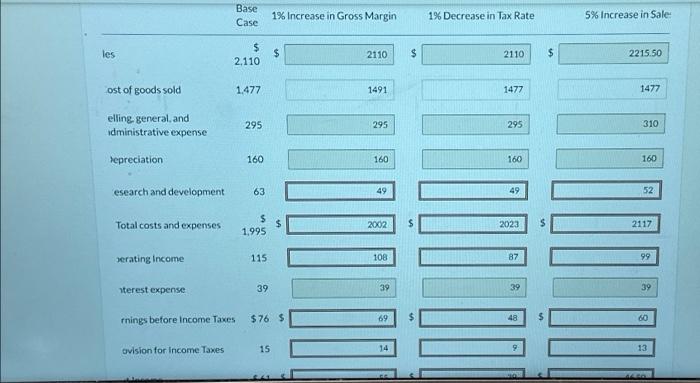

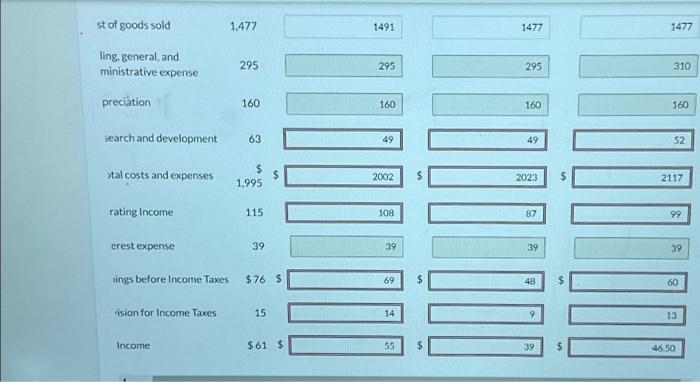

For the base case in this section, as a percentage of sales, COGS=70 percent, SGA =14 percent, R\&D =3.0 percent. Depreciation, Interest expense are fixed as stated. Tax Rate is 20 percent. 1.a 6 Your answer is partially correct. Given the following case, calculate the independent effects of a 1 percent increase in Gross Margin, a 1 percent decrease in the TaxRate, and a 5 percent increase in Sales. \begin{tabular}{|c|c|c|c|c|c|} \hline & \begin{tabular}{l} Base \\ Case \end{tabular} & 1% Increase in Gross Margin & & 1\% Decrease in Tax Rate & \\ \hline les & 2,110 & 2110 & $ & 2110 & $ \\ \hline 4 & & & & & \\ \hline ost of goods sold & 1,477 & 1491 & & 1477 & \\ \hline \begin{tabular}{l} elling-general. and \\ idministrative expense \end{tabular} & 295 & 295 & & 295 & \\ \hline hepreciation & 160 & 160 & & 160 & \\ \hline & & & & & \\ \hline esearch and development & 63 & 49 & & 49 & \\ \hline Total costs and expenses & 1,995$ & 2002 & s & 2023 & $ \\ \hline serating Income & 115 & 108 & & 87 & \\ \hline terest expense & 39 & 39 & & 39 & \\ \hline rnings before income Taxes & $76$ & s s & $ & 48 & $ \\ \hline ovision for income Taxes & 15 & 14 & & 9 & \\ \hline \end{tabular} st of goods sold 1,477 1491 1477 1477 ling.general, and ministrative expense 295 295 295 310 preciation 160 160 160 160 search and development 63 49 49 52 tal costs and expenses rating Income crest expense 1.995 2002 115 108 39 39 $ 2023 87 39 69 $ 48 14 ision for Income Taxes 15 \begin{tabular}{|r|} \hline \\ \hline \\ \hline \\ \hline \end{tabular} 9 $ 60 lings before Income Taxes $76$ \begin{tabular}{l} \hline \\ \hline \\ $ \\ \hline 39 \end{tabular} $61$ 55 Income $61 - $ 13 2117 $ 99 39 60 \begin{tabular}{rr} \hline \\ \hline \\ \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts