Question: For the current pay period, the computer programmer worked 52 hours and the administrator worked 61 hours. Assume further that the social security tax rate

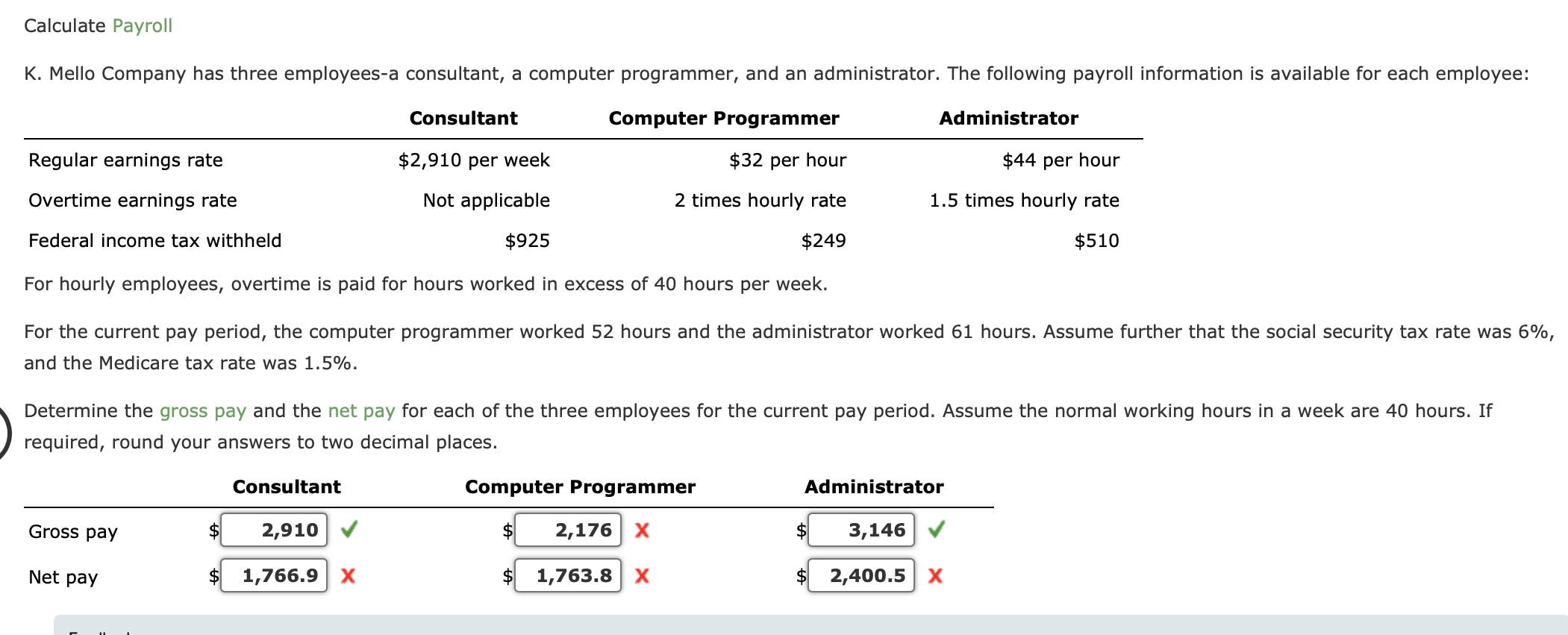

For the current pay period, the computer programmer worked 52 hours and the administrator worked 61 hours. Assume further that the social security tax rate was 6%, and the Medicare tax rate was 1.5%. Determine the gross pay and the net pay for each of the three employees for the current pay period. Assume the normal working hours in a week are 40 hours. If required, round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts