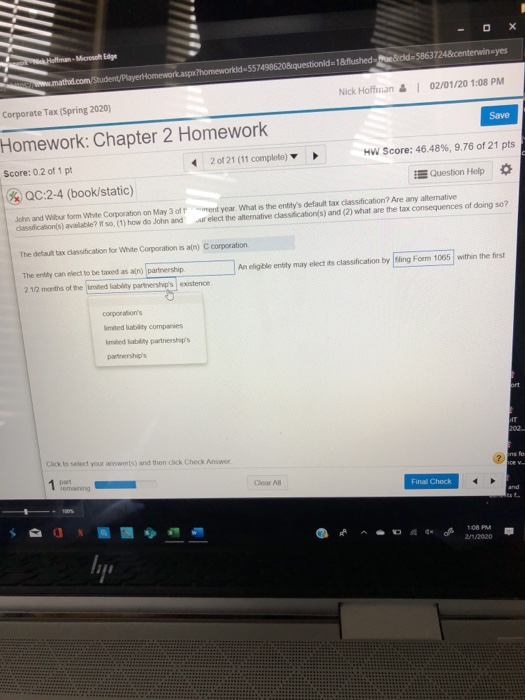

Question: for the first box for the entity can elect to be taxed as an (Limited Liability company, limited liability partnership, partnership, S corp) and for

Hoffman Microsoft Edge - 0 mato.com/StudentPlayerHomeworkshomeworld-5574996208question de 18 flushed ld-5863724¢erwin wye Corporate Tax (Spring 2020) Nick Hoffman & | 02/01/201:08 PM Save Homework: Chapter 2 Homework Score: 0.2 of 1 pt 2 of 21 (11 complete) * QC:2-4 (book/static) HW Score: 46.48%, 9.76 of 21 pts E Question Help John and W desco orm White Corporation on May 3 offrent year What the entity's dete c tion Area t ive b es t how do John and let themative classifications) and (2) what are the tax consequences of doing so? The data cantication for White Corporation is in corporation Theerthy candlet to be a partnership Aneligible 2 12 months of the pres ence y may electis classification by Sing Form 1065 within the first partnership's Click to select your answer(s) and then click Check Ammer Final Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts