Question: For the first problem - why is Bo able to exclude the life insurance policy from his gross income, but Carl is unable to? For

For the first problem - why is Bo able to exclude the life insurance policy from his gross income, but Carl is unable to?

For the second problem - Why is the $1,000 in tuition reduction included as taxable income? Isn't the reduction directly going to his direct costs of being a student?

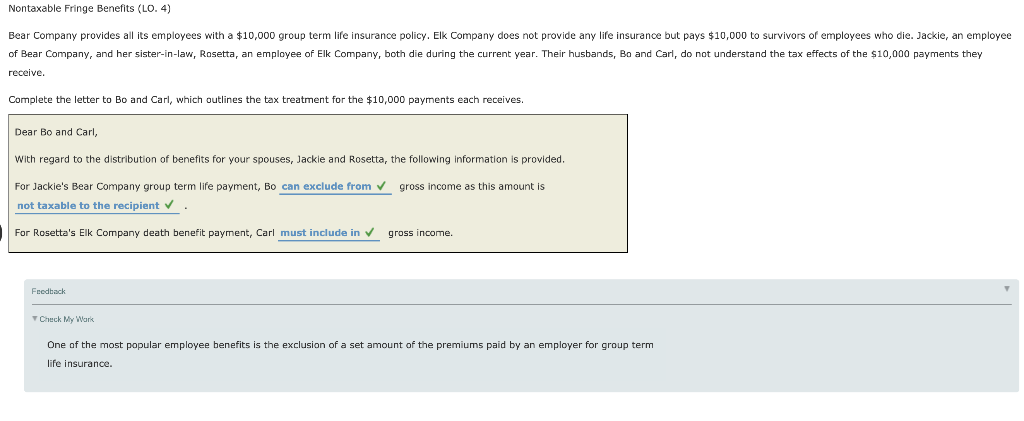

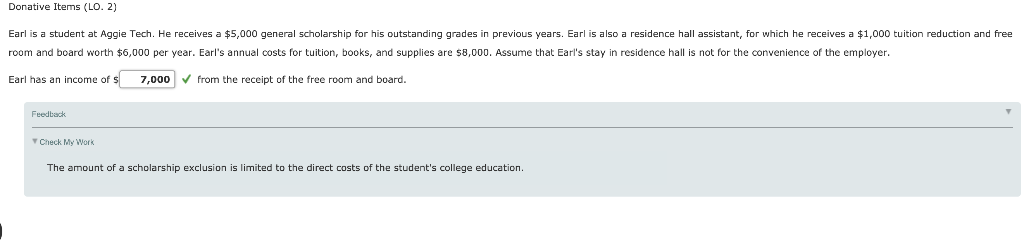

Nontaxable Fringe Benefits (LO. 4) Bear Company provides all its employees with a $10,000 group term life insurance policy. Elk Company does not provide any life insurance but pays $10,000 to survivors of employees who die. Jackie, an employee of Bear Company, and her sister-in-law, Rosetta, an employee of Elk Company, both die during the current year. Their husbands, Bo and Carl, do not understand the tax effects of the $10,000 payments they receive Complete the letter to Bo and Carl, which outlines the tax treatment for the $10,000 payments each receives. Dear Bo and Carl, with regard to the distribution of benefits for your spouses, Jackie and Rosetta, the following information is provided For Jackie's Bear Company group term life payment, Bo can exclude fromgross income as this amount is not taxable to the recipient For Rosetta's Elk Company death benefit payment, Carl must include ingross income Fredback One of the most popular employee benefits is the exclusion of a set amount of the premiums paid by an employer for group term life insurance. Donative Items (LO. 2) Earl is a student at Aggie Tech. He receives a $5,000 general scholarship for his outstanding grades in previous years. Earl is also a residence hall assistant, for which he receives a $1,000 tuition reduction and free room and board worth $6,000 per year. Earl's annual costs for tuition, books, and supplies are $8,000. Assume that Earl's stay in residence hall is not for the convenience of the employer Earl has an income of S.,000 V from the receipt of the free room and board Feedbachk Check My Work The amount of a scholarship exclusion is limited to the direct costs of the student's college education. Nontaxable Fringe Benefits (LO. 4) Bear Company provides all its employees with a $10,000 group term life insurance policy. Elk Company does not provide any life insurance but pays $10,000 to survivors of employees who die. Jackie, an employee of Bear Company, and her sister-in-law, Rosetta, an employee of Elk Company, both die during the current year. Their husbands, Bo and Carl, do not understand the tax effects of the $10,000 payments they receive Complete the letter to Bo and Carl, which outlines the tax treatment for the $10,000 payments each receives. Dear Bo and Carl, with regard to the distribution of benefits for your spouses, Jackie and Rosetta, the following information is provided For Jackie's Bear Company group term life payment, Bo can exclude fromgross income as this amount is not taxable to the recipient For Rosetta's Elk Company death benefit payment, Carl must include ingross income Fredback One of the most popular employee benefits is the exclusion of a set amount of the premiums paid by an employer for group term life insurance. Donative Items (LO. 2) Earl is a student at Aggie Tech. He receives a $5,000 general scholarship for his outstanding grades in previous years. Earl is also a residence hall assistant, for which he receives a $1,000 tuition reduction and free room and board worth $6,000 per year. Earl's annual costs for tuition, books, and supplies are $8,000. Assume that Earl's stay in residence hall is not for the convenience of the employer Earl has an income of S.,000 V from the receipt of the free room and board Feedbachk Check My Work The amount of a scholarship exclusion is limited to the direct costs of the student's college education

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts