Question: for the first question part A is finished and correct answer part B. for the 2nd question the five-year is correct and complete answer the

for the first question part A is finished and correct answer part B.

for the first question part A is finished and correct answer part B.

for the 2nd question the five-year is correct and complete answer the 20 yr face value for A and B

for the 2nd question the five-year is correct and complete answer the 20 yr face value for A and B

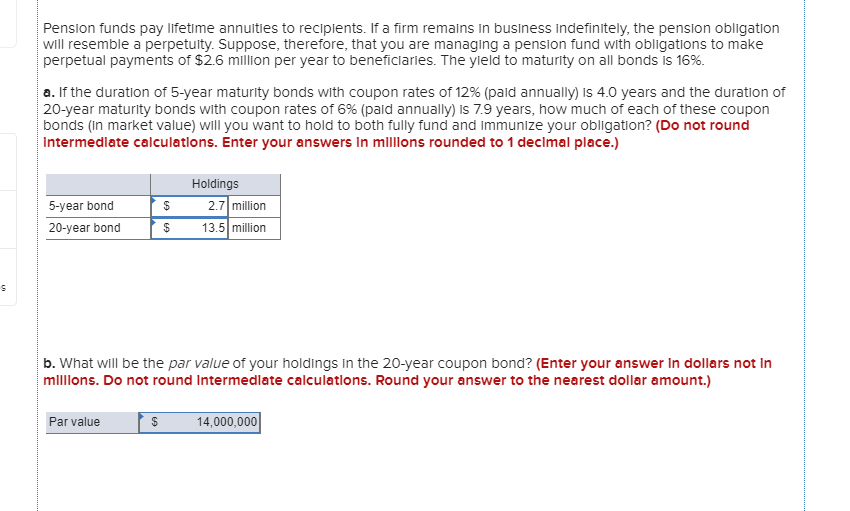

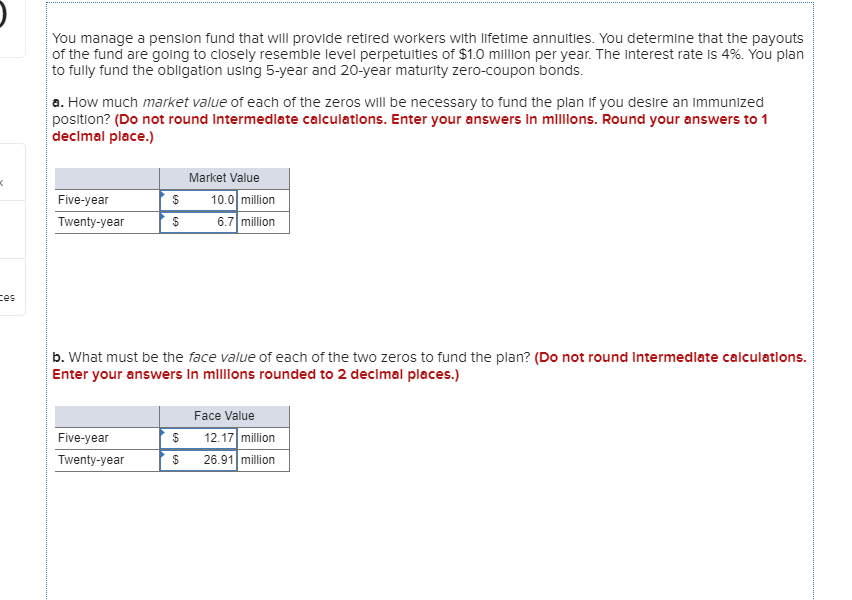

Pension funds pay lifetime annuities to recipients. If a firm remains in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of $2.6 million per year to beneficiaries. The yield to maturity on all bonds is 16%. a. If the duration of 5-year maturity bonds with coupon rates of 12% (paid annually) is 4.0 years and the duration of 20-year maturity bonds with coupon rates of 6% (paid annually) is 7.9 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and Immunize your obligation? (Do not round Intermediate calculations. Enter your answers in millions rounded to 1 decimal place.) 5-year bond 20-year bond $ $ Holdings 2.7 million 13.5 million b. What will be the par value of your holdings in the 20-year coupon bond? (Enter your answer in dollars not in millions. Do not round Intermediate calculations. Round your answer to the nearest dollar amount.) Par value $ 14,000,000 You manage a pension fund that will provide retired workers with lifetime annuities. You determine that the payouts of the fund are going to closely resemble level perpetuities of $1.0 million per year. The interest rate is 4%. You plan to fully fund the obligation using 5-year and 20-year maturity zero-coupon bonds. a. How much market value of each of the zeros will be necessary to fund the plan if you desire an immunized position? (Do not round Intermediate calculations. Enter your answers in millions. Round your answers to 1 decimal place.) Five-year $ $ Market Value 10.0 million 6.7 million Twenty-year b. What must be the face value of each of the two zeros to fund the plan? (Do not round Intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Five-year Twenty-year $ $ Face Value 12.17 million 26.91 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts