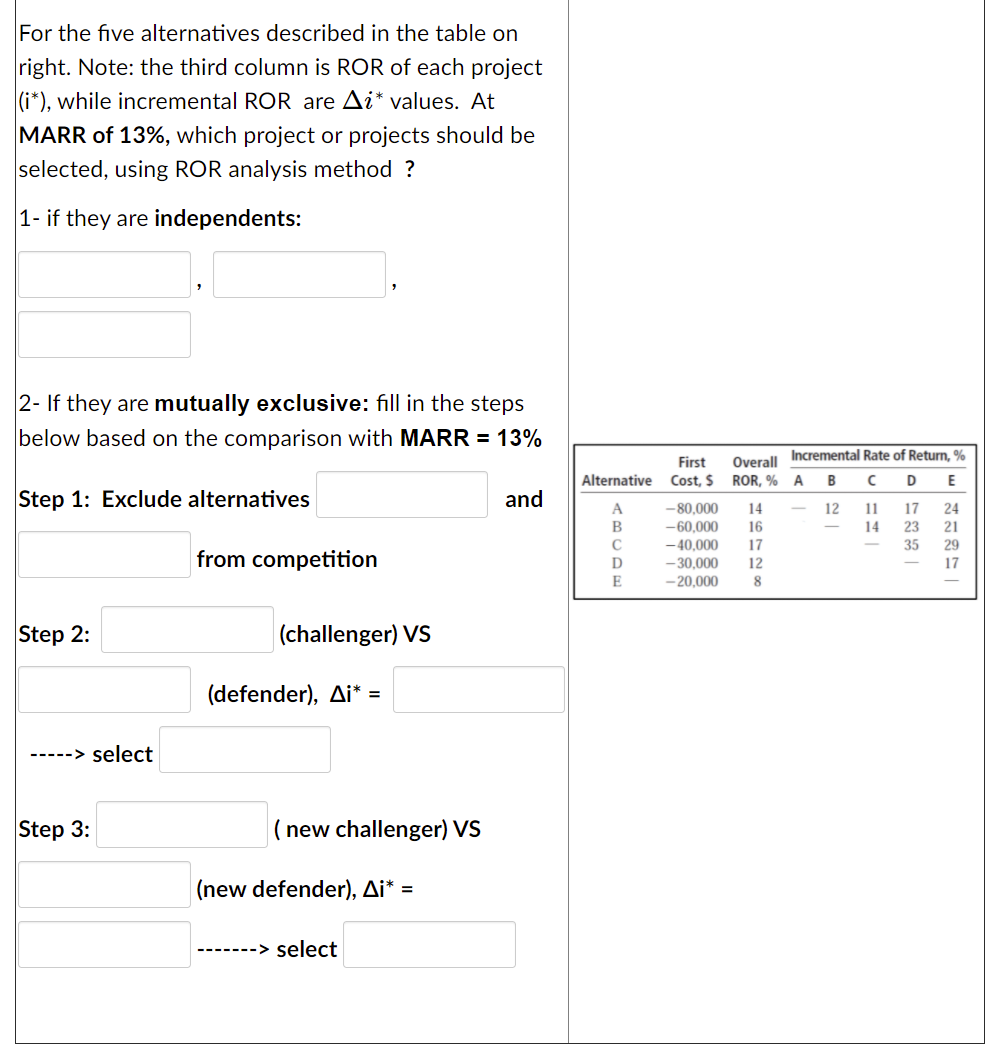

Question: For the five alternatives described in the table on right. Note: the third column is ROR of each project (i*), while incremental ROR are Ai*

For the five alternatives described in the table on right. Note: the third column is ROR of each project (i*), while incremental ROR are Ai* values. At MARR of 13%, which project or projects should be selected, using ROR analysis method ? 1- if they are independents: 2- If they are mutually exclusive: fill in the steps below based on the comparison with MARR = 13% Step 1: Exclude alternatives and First Alternative cost, $ A -80,000 B -60,000 - 40,000 D - 30.000 E -20,000 Overall Incremental Rate of Return, % ROR, % A B D E 14 12 11 17 24 16 14 23 21 17 35 29 12 17 8 from competition Step 2: (challenger) VS (defender), Ai* = -----> select Step 3: (new challenger) VS (new defender), Ai* = -------> select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts