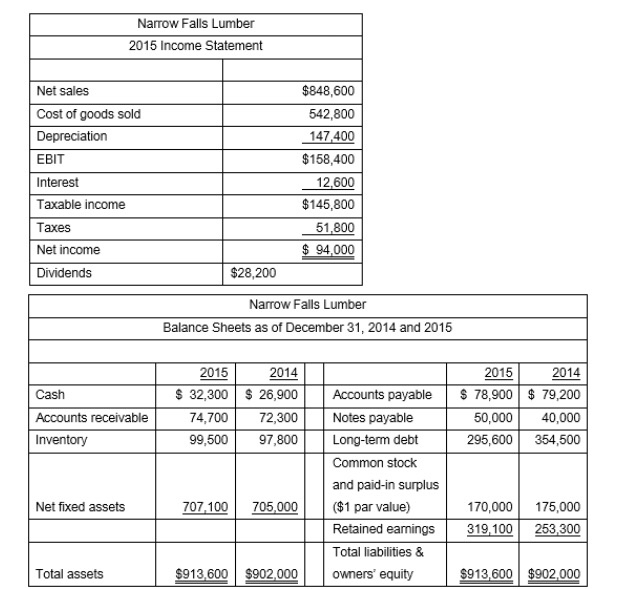

Question: For the following problems (29-36), use the data from the Narrow Falls Lumber's Income Statement and Balance Sheet, please refer to attached photo. 29. Calculate

Narrow Falls Lumber 2015 Income Statement Net sales Cost of goods sold Depreciation EBIT Interest Taxable income Taxes Net income Dividends $848,600 542,800 147.400 $158,400 12,600 $145,800 51,800 94,000 $28,200 Narrow Falls Lumber Balance Sheets as of December 31, 2014 and 2015 2015 2014 2014 26,900 Accounts payable 78,900$ 79,200 50,00040,000 295,600354,500 2015 Cash $ 32,300 Accounts receivable 74,70072,300 Notes payable 99,50097,800 Long-term debt Common stock and paid-in surplus Net fixed assets 707 100 705,000($1 par value) 170,000175,000 319,100 253 300 Retained earnings Total liabilities & Total assets $913,600 $902,000owners equity $913,600 $902,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts