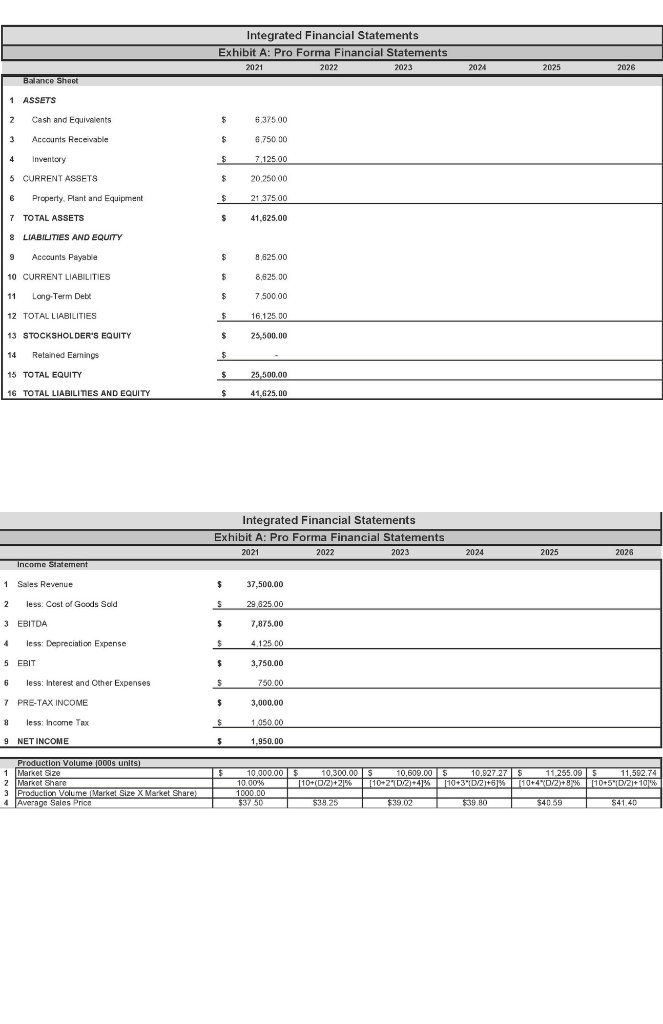

Question: For the following problems, use Exhibit A. For exhibit A, the amount of sales depends on the production volume shown below. The dividend policy is

For the following problems, use Exhibit A. For exhibit A, the amount of sales depends on the production volume shown below. The dividend policy is to pay 29% in dividends. Construct the Production volume table based on your student ID number as per the instructions shown below

- What will be the accounts payable for 2024?

Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2021 2022 2023 2024 2025 2026 Balance Sheet 1 ASSETS 2 Cash and Equivalents $ 6.375 00 3 Accounts Receivable $ 6.750 00 4 4 Inventory $ 7,125.00 5 CURRENT ASSETS $ 20.250 00 6 Property. Plant and Equipment $ 21 375.00 7 TOTAL ASSETS $ 41,625.00 8 LIABILITIES AND EQUITY $ 8.625.00 Accounts Payable 10 CURRENT LIABILITIES $ 8,625.00 11 Long-Term Debe $ $ 7,500.00 16.125.00 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY $ 25.500,00 14 Retained Earnings $ 15 TOTAL EQUITY $ 25,500.00 16 TOTAL LIABILITIES AND EQUITY $ 41,625.00 Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2021 2022 2023 2024 2025 2026 Income Statement 1 Sales Revenue $ 37,500.00 2 less. Cost of Goods Sold 5 29 625.00 3 EBITDA $ 7,875.00 $ 4.125.00 4 less: Depreciation Expense 5 EBIT $ 3,750.00 6 less: Interest and Other Expenses 5 750.00 7 PRE-TAX INCOME $ $ 3,000.00 8 less: Income Tax $ 1.050 oC 9 NET INCOME $ 1,950.00 Production Volume 1000s units) 1 Market Size 2 Market Share 3 Production Volume (Market Size X Market Share) 4 Average Sales Prion 10.000.00 $ 10,300.00 S 10,609.00 $ 10.827 275 11.255.095 11,592.74 10.00% [+ 10+(0/2+21% 110-2D2+4% 10+3 10/21+63% 119+490/2+9% 10+5 10/21+10% 6% 10)9941106T12% 1000.00 $37.50 $38.25 539.02 $39.80 $40.59 S41.40 Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2021 2022 2023 2024 2025 2026 Balance Sheet 1 ASSETS 2 Cash and Equivalents $ 6.375 00 3 Accounts Receivable $ 6.750 00 4 4 Inventory $ 7,125.00 5 CURRENT ASSETS $ 20.250 00 6 Property. Plant and Equipment $ 21 375.00 7 TOTAL ASSETS $ 41,625.00 8 LIABILITIES AND EQUITY $ 8.625.00 Accounts Payable 10 CURRENT LIABILITIES $ 8,625.00 11 Long-Term Debe $ $ 7,500.00 16.125.00 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY $ 25.500,00 14 Retained Earnings $ 15 TOTAL EQUITY $ 25,500.00 16 TOTAL LIABILITIES AND EQUITY $ 41,625.00 Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2021 2022 2023 2024 2025 2026 Income Statement 1 Sales Revenue $ 37,500.00 2 less. Cost of Goods Sold 5 29 625.00 3 EBITDA $ 7,875.00 $ 4.125.00 4 less: Depreciation Expense 5 EBIT $ 3,750.00 6 less: Interest and Other Expenses 5 750.00 7 PRE-TAX INCOME $ $ 3,000.00 8 less: Income Tax $ 1.050 oC 9 NET INCOME $ 1,950.00 Production Volume 1000s units) 1 Market Size 2 Market Share 3 Production Volume (Market Size X Market Share) 4 Average Sales Prion 10.000.00 $ 10,300.00 S 10,609.00 $ 10.827 275 11.255.095 11,592.74 10.00% [+ 10+(0/2+21% 110-2D2+4% 10+3 10/21+63% 119+490/2+9% 10+5 10/21+10% 6% 10)9941106T12% 1000.00 $37.50 $38.25 539.02 $39.80 $40.59 S41.40

Step by Step Solution

There are 3 Steps involved in it

To answer the question about the accounts payable for 2024 we need to analyze the pro forma financia... View full answer

Get step-by-step solutions from verified subject matter experts