Question: For the following problems, use Exhibit B. Exhibit B has the balance sheet and Income Statement projections for a specific company. The company is evaluating

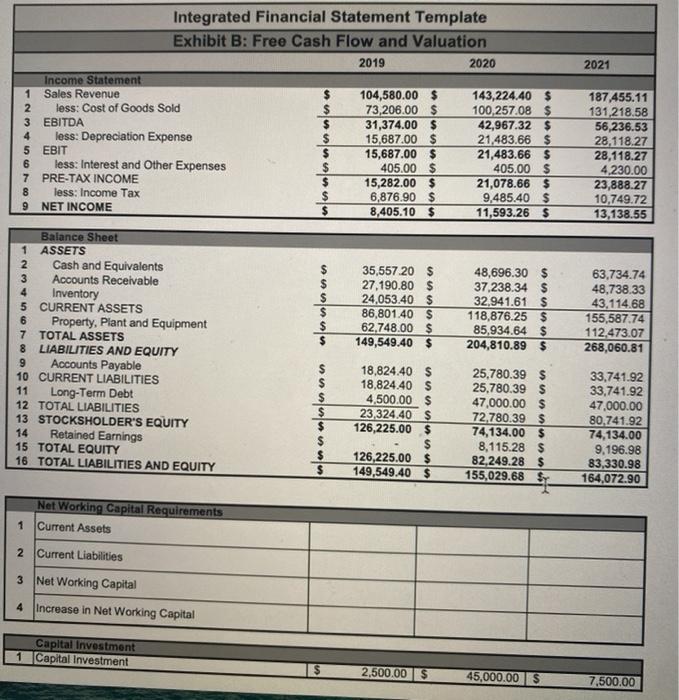

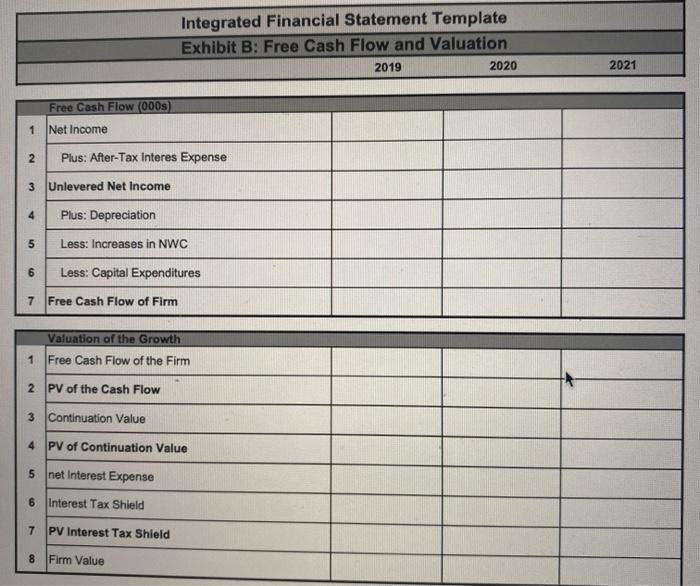

For the following problems, use Exhibit B. Exhibit B has the balance sheet and Income Statement projections for a specific company. The company is evaluating if it is worth it to have the capital investment as showed in the Capital Investment Table. The EBITDA multiplier of similar companies 5.2. The debt used has a coupon of 12.5%. The WACC is 18% NOTE: Provide your answers in dollars. E.G. for 100M you must enter 100000000.0000, for 20M you must enter 20000000.000, etc. a. What is the increase in Net Working Capital for 2020? I b. What is the increase in Net Working Capital for 2021? c. What would be the Free Cash Flow for 2020? d. What would be the Free Cash Flow for 2021? e. What is the present value of the Free cash flows? f. What is the present value of the continuation value for the firm? g. What is the present value of the Interest Tax Shield? h. What is the Firm Value with the expansion of the project? 2021 Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 Income Statement 1 Sales Revenue 104,580.00 $ 143,224.40 $ 2 less: Cost of Goods Sold $ 73,206.00 $ 100,257.08 $ 3 EBITDA 31,374.00 $ 42,967.32 $ 4 less: Depreciation Expense $ 15,687.00 $ 21,483.66 $ 5 EBIT $ 15,687.00 $ 21,483.66 $ 6 less: Interest and Other Expenses $ 405.00 $ 405.00 $ 7 PRE-TAX INCOME $ 15,282.00 $ 21,078.66 $ 8 less: Income Tax $ 6,876.90 $ 9,485.40 $ 9 NET INCOME $ 8,405.10 $ 11,593.26 5 187,455.11 131,218.58 56,236.53 28.118.27 28,118.27 4,230.00 23,888.27 10,749.72 13,138.55 $ $ $ $ $ $ 35,557.20 $ 27,190.80 $ 24,053.40 $ 86,801.40 $ 62.748.00 $ 149,549.40 $ Balance Sheet 1 ASSETS 2 Cash and Equivalents 3 Accounts Receivable 4 Inventory 5 CURRENT ASSETS 6 Property, Plant and Equipment 7 TOTAL ASSETS 8 LIABILITIES AND EQUITY 9 Accounts Payable 10 CURRENT LIABILITIES 11 Long-Term Debt 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY Retained Earnings 15 TOTAL EQUITY 16 TOTAL LIABILITIES AND EQUITY 48,696.30 $ 37.238.34 $ 32,941.61 $ 118,876.25 $ 85,934.64 $ 204,810.89 $ 63,734.74 48,738.33 43,114.68 155,587.74 112,473.07 268,060.81 nennenlinnon 18,824.40 $ 18,824.40 $ 4,500.00 $ 23,324.40 $ 126,225.00 $ $ 126,225.00 $ 149,549.40 $ 25,780.39 $ 25,780.39 $ 47,000.00 $ 72.780.39 $ 74,134.00 $ 8,115.28 $ 82,249.28 $ 155,029.68 $ 33,741.92 33,741.92 47,000.00 80.741.92 74,134.00 9.196.98 83,330.98 164,072.90 Net Working Capital Requirements 1 Current Assets 2 2 Current Liabilities 3 Net Working Capital 4 Increase in Net Working Capital Capital Investment 1 Capital Investment 2,500.00 $ 45,000.00 $ 7,500.00 Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 2021 Free Cash Flow (000s) 1 Net Income 2 Plus: After-Tax Interes Expense 3 Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm Valuation of the Growth 1 Free Cash Flow of the Firm 2 PV of the Cash Flow 3 Continuation Value 4 PV of Continuation Value 5 net Interest Expense 6 Interest Tax Shield 7 PV Interest Tax Shield 8 Firm Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts