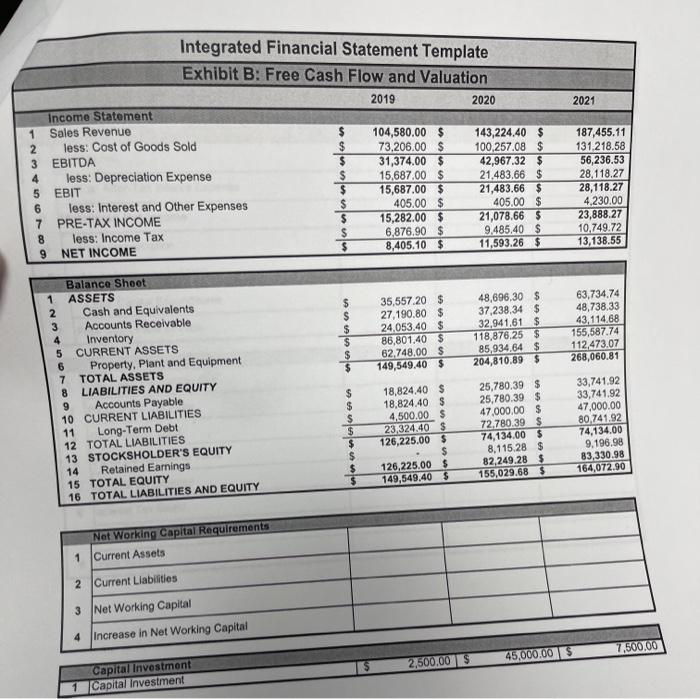

Question: FOR THE FOLLOWING PROBLEMS, USE EXHIBIT B. EXHIBIT B HAS THE BALANCE SHEET AND INCOME STATEMENT PROJECTIONS FOR A SPECIFIC COMPANY. THE COMPANY IS EVALUATING

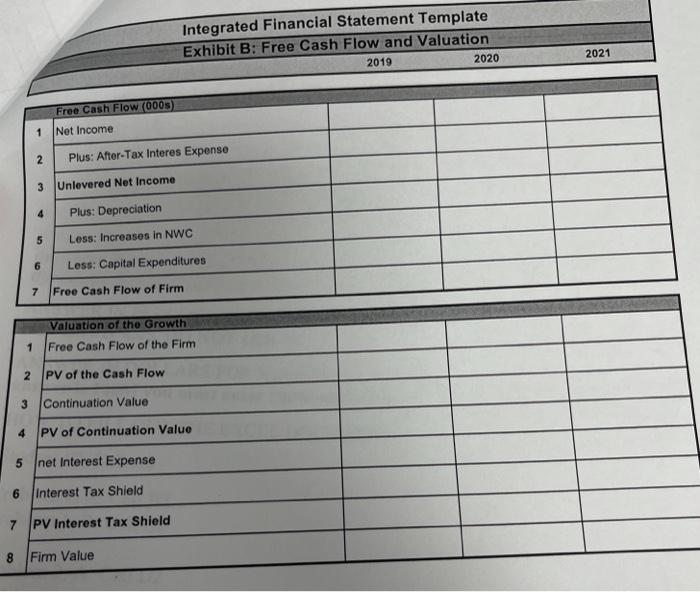

2021 Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 Income Statement 1 Sales Revenue $ 104,580.00 $ 143,224.40 $ 2 less: Cost of Goods Sold $ 73,206.00 $ 100,257.08 $ 3 EBITDA $ 31,374.00 $ 42,967.32 $ 4 less: Depreciation Expense $ 15,687.00 $ 21.483.66 $ 5 EBIT $ 15,687.00 $ 21,483.66 $ 6 less: Interest and Other Expenses 405.00 $ 405.00 $ 7 PRE-TAX INCOME $ 15,282.00 $ 21,078.66 $ 8 less: Income Tax $ 6,876.90 $ 9.485.40 $ 9 NET INCOME $ 8,405.10$ 11,593.26 $ 187,455.11 131,218.58 56,236.53 28,118.27 28,118.27 4,230,00 23,888.27 10,749.72 13,138.55 N oluen 35.557.20 $ 27.190.80 $ 24.053.40 $ 86,801.40 $ 62.748.00 $ 149,549.40 $ 48,696,30 $ 37,238.34 $ 32,941.61 $ 118,876.25 $ 85,934.64 $ 204,810.89 $ 63,734.74 48,738.33 43,114.68 155,587.74 112.473.07 268,060.81 $ $ Balance Sheet 1 ASSETS Cash and Equivalents 3 Accounts Receivable 4 Inventory 5 CURRENT ASSETS 6 Property. Plant and Equipment 7 TOTAL ASSETS 8 LIABILITIES AND EQUITY 9 Accounts Payable 10 CURRENT LIABILITIES 11 Long-Term Debt 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY 14 Retained Earnings 15 TOTAL EQUITY 16 TOTAL LIABILITIES AND EQUITY ulus non 18,824,40 $ 18,824.40 $ 4,500.00 $ 23,324.40 $ 126,225.00 $ $ 126,225.00 $ 149,549.40 $ 25,780.39 $ 25,780.39 $ 47,000.00 $ 72,780.39 $ 74,134.00 $ 8,115.28 $ 82,249.28 $ 155,029.68 $ 33,741.92 33,741.92 47,000.00 80.741.92 74.134.00 9,196.98 83,330.98 164,072.90 Net Working Capital Requirements Current Assets 1 2 Current Liabilities 3 Net Working Capital 4 Increase in Net Working Capital 7,500.00 45,000.00$ 2,500.00 Capital Investmont 1 Capital Investment Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 2021 Free Cash Flow 000S 1 Net Income 2 Plus: After-Tax Interes Expense 3 Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm Valuation of the Growth 1 Free Cash Flow of the Firm 2 PV of the Cash Flow 3 Continuation Value 4 PV of Continuation Value 5 net Interest Expense 6 Interest Tax Shield 7 PV Interest Tax Shield 8 Firm Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts