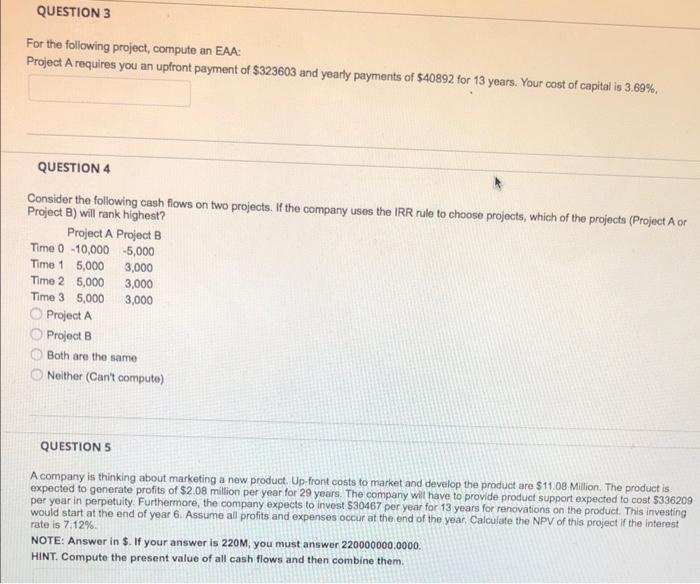

Question: For the following project, compute an EAA: Project A requires you an upfront payment of $323603 and yearly payments of $40892 for 13 years. Your

For the following project, compute an EAA: Project A requires you an upfront payment of $323603 and yearly payments of $40892 for 13 years. Your cost of capital is 3.69%, QUESTION 4 Consider the following cash flows on two projects. If the company uses the IRR rule to choose projects, which of the projects (Project A or Projoct B) will rank highest? Project A Project B Both are the same Neither (Can't compute) QUESTION 5 A company is thinking about marketing a new product. Up-front costs to market and develop the product are \$11.08 Million. The product is expected to generate profits of $2.08 million per year for 29 years. The company with have to provide product support expected to cost $336209 per yoar in perpetuity. Furthermore, the company expects to invost $30467 per year for 13 years for renovations on the product. This investing would start at the end of year 6. Assume all profits and expenses occur at the end of the year, Calculate the NPV of this project if the interest rate is 7,12%. NOTE: Answer in \$. If your answer is 220M, you must answer 220000000.0000. HINT. Compute the present value of all cash flows and then combine them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts