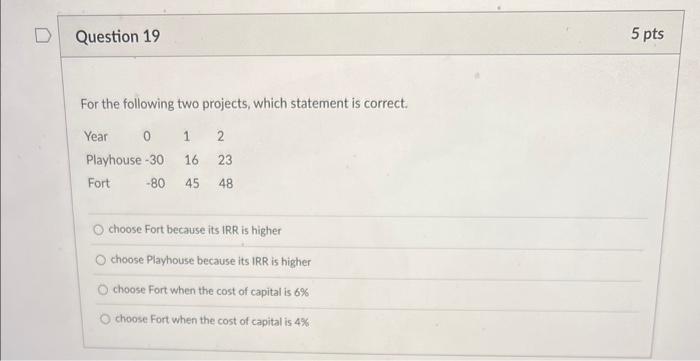

Question: For the following two projects, which statement is correct. choose Fort because its IRR is higher choose Playhouse because its IRR is higher choose Fort

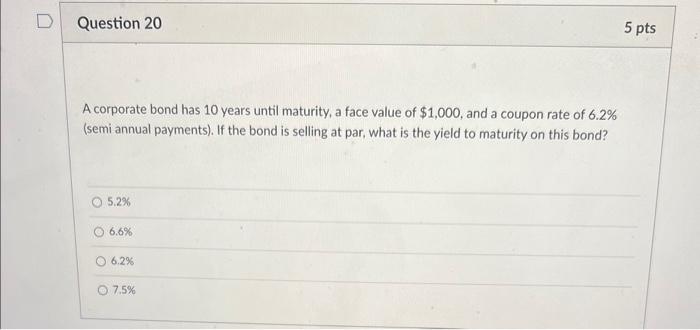

For the following two projects, which statement is correct. choose Fort because its IRR is higher choose Playhouse because its IRR is higher choose Fort when the cost of capital is 6% choose Fort when the cost of capital is 4% A corporate bond has 10 years until maturity, a face value of $1,000, and a coupon rate of 6.2% (semi annual payments). If the bond is selling at par, what is the yield to maturity on this bond? 5.2% 6.6% 6.2% 7.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts