Question: For the highlighted section, what would ROE, Return on Assets, Gross Profit Margin and Net Profit Margin be? FINANCIAL SUMMARY ($M) (52 weeks) (53 weeks)

For the highlighted section, what would ROE, Return on Assets, Gross Profit Margin and Net Profit Margin be?

For the highlighted section, what would ROE, Return on Assets, Gross Profit Margin and Net Profit Margin be?

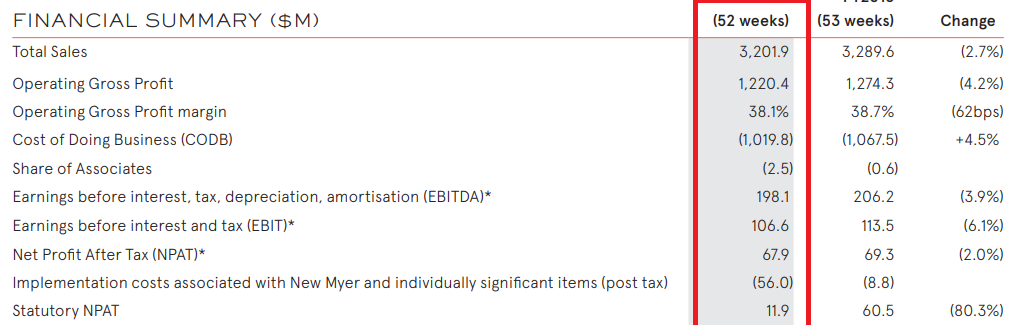

FINANCIAL SUMMARY ($M) (52 weeks) (53 weeks) Change Total Sales 3,201.9 3,289.6 (2.7%) 1,220.4 1,274.3 (4.2%) 38.1% 38.7% (62bps) +4.5% Operating Gross Profit Operating Gross Profit margin Cost of Doing Business (CODB) Share of Associates Earnings before interest, tax, depreciation, amortisation (EBITDA)* Earnings before interest and tax (EBIT)* Net Profit After Tax (NPAT)* Implementation costs associated with New Myer and individually significant items (post tax) Statutory NPAT (1,019.8) (2.5) 198.1 (1,067.5) (0.6) 206.2 (3.9%) 106.6 113.5 (6.1%) 67.9 69.3 (2.0%) (56.0) (8.8) 11.9 60.5 (80.3%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts