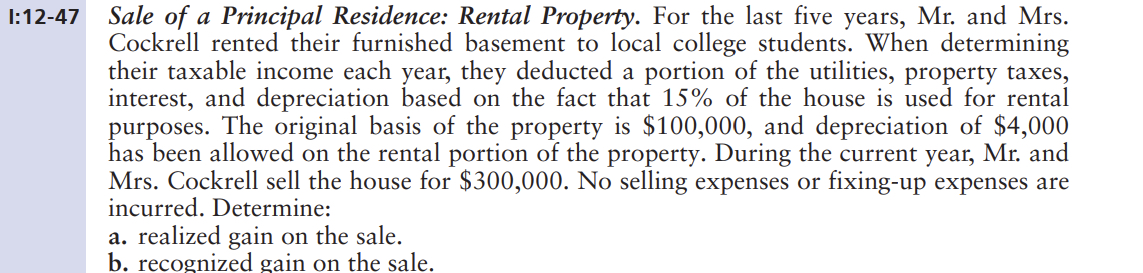

Question: . For the last five years, Mr . and Mrs . Cockrell rented their furnished basement to local college students. When determining their taxable income

For the last five years, Mr and Mrs

Cockrell rented their furnished basement to local college students. When determining

their taxable income each year, they deducted a portion of the utilities, property taxes,

interest, and depreciation based on the fact that of the house is used for rental

purposes. The original basis of the property is $ and depreciation of $

has been allowed on the rental portion of the property. During the current year, Mr and

Mrs Cockrell sell the house for $ No selling expenses or fixingup expenses are

incurred. Determine:

a realized gain on the sale.

b recognized gain on the sale.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock